State of Student Aid in Texas – 2021

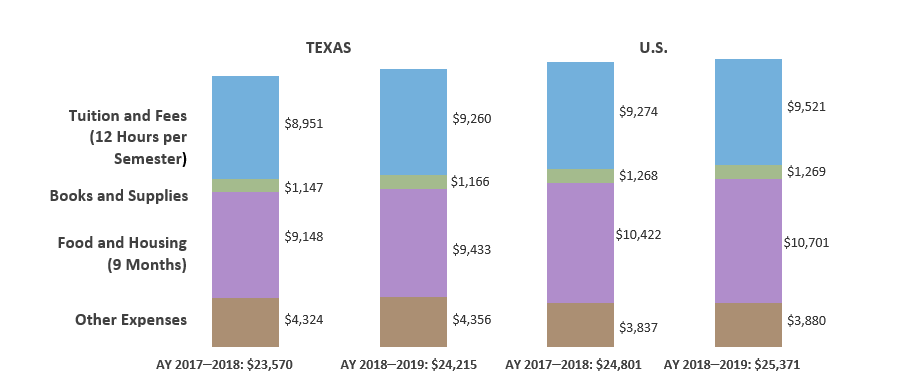

Texas Public Four-Year University Cost of Attendance Below National Average

Weighted Average Public Four-year University Cost of Attendance for Two Semesters for Full-time Undergraduates Living Off Campus in Texas and the U.S. (AY 2017–2018 and AY 2018–2019)

* An institution’s costs are multiplied by its enrollment. The sum of costs for all schools is then divided by full-time, undergraduate enrollment, such that schools with higher enrollments are given greater weight. See glossary for clarification.

** 12 semester hours or more.

*** EFC is determined through a federal formula that considers family income and size as well as the number of children in college, among other factors. The average amount that families actually contribute to educational expenses is unknown. In AY 2015–2016, 18 percent of dependent undergraduates enrolled at public four-year universities nationwide reported that they received no help from their parents in paying education and living expenses.

Sources: All Costs and Enrollments for 2018–2019: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2018 (http://nces.ed.gov/ipeds/); All Costs and Enrollments for 2017–2018: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2017 (http://nces.ed.gov/ipeds/); All other: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

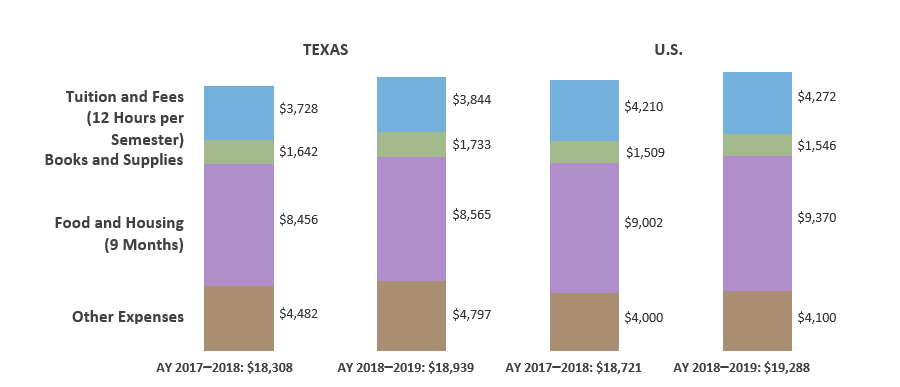

Texas Public Two-Year Colleges Cost Below The National Average

Weighted Average Public Two-year College Cost of Attendance for Two Semesters for Full-time Undergraduates Living Off Campus in Texas and the U.S. (AY 2017–2018 and AY 2018–2019)

* 12 semester hours or more.

** An institution’s costs are multiplied by its enrollment. The sum of costs for all schools is then divided by full-time, undergraduate enrollment, such that schools with higher enrollments are given greater weight. See glossary for clarification.

*** EFC is determined through a federal formula that considers family income and size as well as the number of children in college, among other factors. The average amount that families actually contribute to educational expenses is unknown. In AY 2015–2016, 29 percent of dependent undergraduates enrolled in public two-year colleges nationwide reported that they received no help from their parents in paying education and living expenses.

Sources: All Costs and Enrollments for 2018–2019: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2018 (http://nces.ed.gov/ipeds/); All Costs and Enrollments for 2017–2018: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2017 (http://nces.ed.gov/ipeds/); All other: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

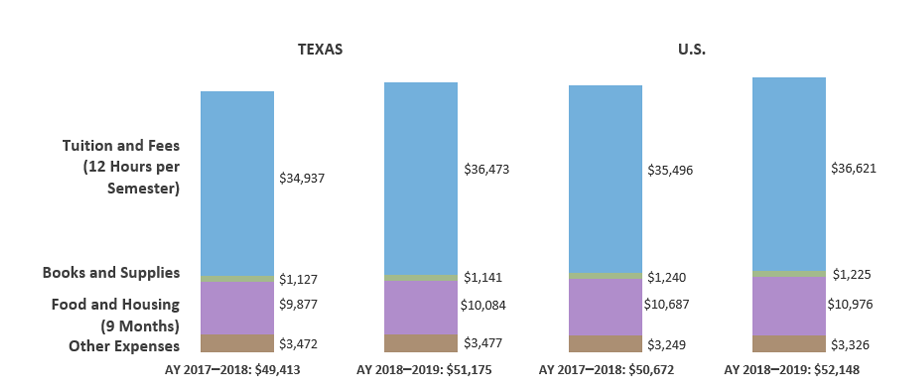

Costs at Texas Private Four-Year Universities Still Less Than National Average

Weighted Average Private Four-year University Cost of Attendance for Two Semesters for Full-time Undergraduates Living Off Campus in Texas and the U.S. (AY 2017–2018 and AY 2018–2019)

* An institution’s costs are multiplied by its enrollment. The sum of costs for all schools is then divided by full-time, undergraduate enrollment, such that schools with higher enrollments are given greater weight. See glossary for clarification.

** 12 semester hours or more.

*** EFC is determined through a federal formula that considers family income and size as well as the number of children in college, among other factors. The average amount that families actually contribute to educational expenses is unknown. In AY 2015–2016, 17 percent of dependent undergraduates enrolled at private four-year universities nationwide reported that they received no help from their parents in paying education and living expenses.

Sources: All Costs and Enrollments for 2018–2019: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2018 (http://nces.ed.gov/ipeds/); All Costs and Enrollments for 2017–2018: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2017 (http://nces.ed.gov/ipeds/); All other: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

The Cost of Going to College Continues to Rise Each Year

Change in Costs for Students Living Off Campus: Dollar and Percentage Change (AY 2017–2018 to AY 2018–2019, Costs Weighted for Enrollment*)

| Texas | Public Four-Year | Public Two-Year | Private Four-Year | |||

|---|---|---|---|---|---|---|

| $ | % | $ | % | $ | % | |

| Tuition and Fees (12 Hours / Semester) | $309 | 3% | $116 | 3% | $1,536 | 4% |

| Books and Supplies | $19 | 2% | $91 | 6% | $14 | 1% |

| Food and Housing | $285 | 3% | $109 | 1% | $207 | 2% |

| Other | $32 | 1% | $315 | 7% | $5 | 0% |

| Total Change | $645 | 3% | $631 | 3% | $1,762 | 4% |

| U.S. | Public Four-Year | Public Two-Year | Private Four-Year | |||

|---|---|---|---|---|---|---|

| $ | % | $ | % | $ | % | |

| Tuition and Fees (12 Hours / Semester) | $247 | 3% | $62 | 1% | $1,125 | 3% |

| Books and Supplies | $1 | 0% | $37 | 2% | -$15 | -1% |

| Food and Housing | $279 | 3% | $368 | 4% | $289 | 3% |

| Other | $43 | 1% | $100 | 3% | $77 | 2% |

| Total Change | $570 | 2% | $567 | 3% | $1,476 | 3% |

* An institution’s costs are multiplied by its enrollment. The sum of costs for all schools is then divided by full-time, undergraduate enrollment, such that schools with higher enrollments are given greater weight. See glossary for clarification.

** 35 or more hours per week; includes work-study/assistantship.

Sources: All Costs and Enrollments for 2018–2019: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2018 (http://nces.ed.gov/ipeds/); All Costs and Enrollments for 2017–2018: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2017 (http://nces.ed.gov/ipeds/); Housing Demand: The Hechinger Report, “The Hidden Risk in Off-Campus Housing Costs,” August 23, 2019 (https://hechingerreport.org/the-hidden-risk-in-off-campus-housing-costs/); All other: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

Living Situation Key to Staying Within Average Room and Board Budgets at Texas Public Universities

Average USDA/HUD Food and Housing Costs for Two Semesters (9 Months) for Counties and MSAs*** Where Texas Public Universities Are Located (AY 2018–2019)

| Student sharing 1-bedroom unit | Student sharing 2-bedroom unit | Student living alone in 1-bedroom unit | Single parent student with 1 child in 2-bedroom unit | |

|---|---|---|---|---|

| Food | $2,427 | $2,427 | $2,427 | $3,648 |

| Housing | $3,657 | $4,515 | $7,315 | $9,030 |

| Total Food and Housing | $6,084 | $6,942 | $9,742 | $12,678 |

| Average Room and Board Budget | $9,030 | $9,030 | $9,030 | $9,030 |

*$9,433 when weighted for enrollment; see glossary for clarification. ** Based on the cost at Conan’s Pizza near the University of Texas at Austin, March 2020. *** A Metropolitan Statistical Area is a geographic area of 50,000 or more inhabitants.

Sources: All Costs and Enrollments for 2018–2019: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2018 (http://nces.ed.gov/ipeds/); U.S. Department of Agriculture. “Official USDA Food Plans: Cost of Food at Home at Four Levels, U.S. Average, June 2019.” (https://www.fns.usda.gov/cnpp/usda-food-plans-cost-food-reports-monthly-report); U.S. Department of Housing and Urban Development (HUD). “Fair Market Rents 2019 for Existing Housing, October 2019,” (http://www.huduser.org/datasets/fmr.html); All other: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

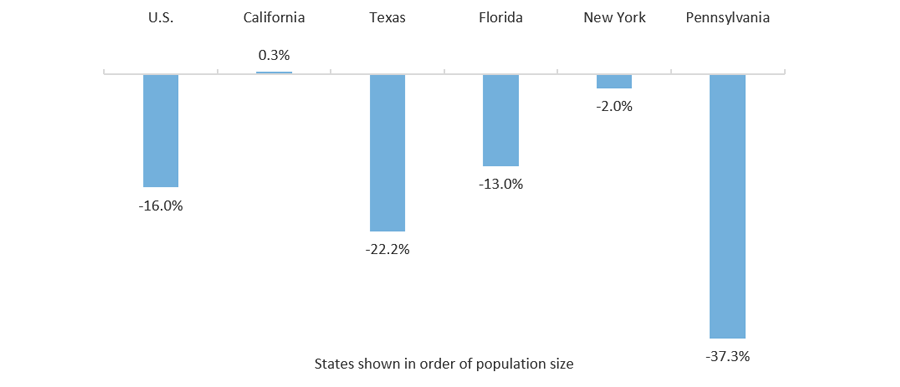

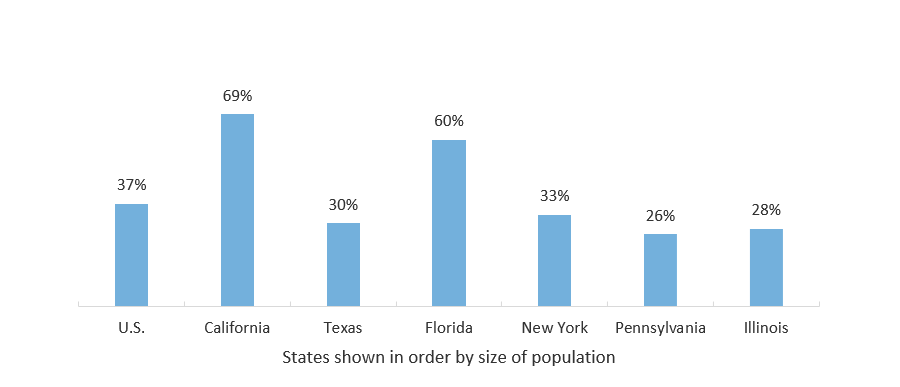

Average Tuition at Texas Public Four-Year Institutions Has Increased by 30 Percent Since 2008, Lower Than for the U.S.

Percent Change in Average Tuition at Public Four-Year Colleges, Inflation Adjusted, 2008-2018

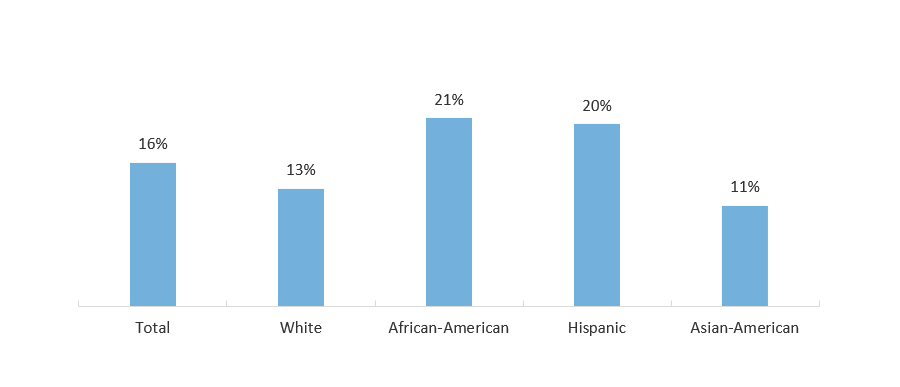

Average Tuition and Fees at a Texas Public Four-Year University as a Percentage of Texas Median Household Income, by Race (2017)

Sources: Center on Budget and Policy Priorities, State Higher Education Funding Cuts Have Pushed Costs to Students, Worsened Inequality, October 2019 (https://www.cbpp.org/research/state-budget-and-tax/state-higher-education-funding-cuts-have-pushed-costs-to-students); Center on Budget and Policy Priorities, States Grappling with Hit to Tax Collections, August 2020 (https://www.cbpp.org/research/state-budget-and-tax/states-grappling-with-hit-to-tax-collections).

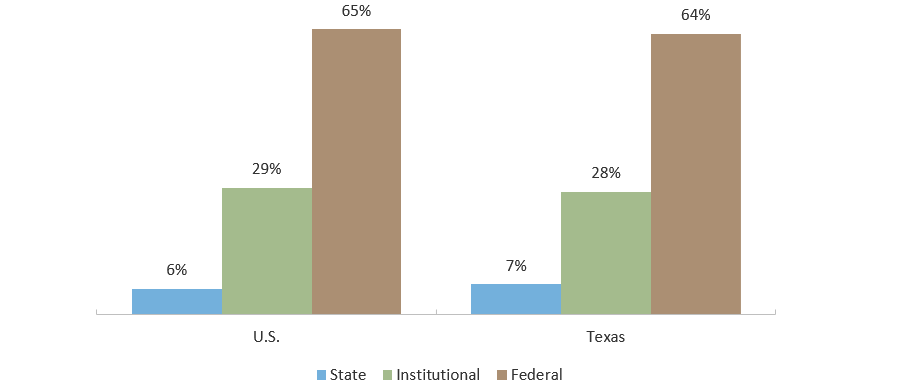

Nearly Two-Thirds of Student Aid Comes from the Federal Government

Direct Student Aid by Source (AY 2018-2019*)

* Direct student aid includes aid that is generally available, goes directly to students, and derives from state and federal appropriations, plus institutional grants.

**The State of Texas, like other state governments, also supports public institutions through direct appropriations and tuition waivers.

Sources: Aid in Texas: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2019 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2018/); Aid in the U.S.: The College Board. Trends in Student Aid 2019 (http://trends.collegeboard.org/).

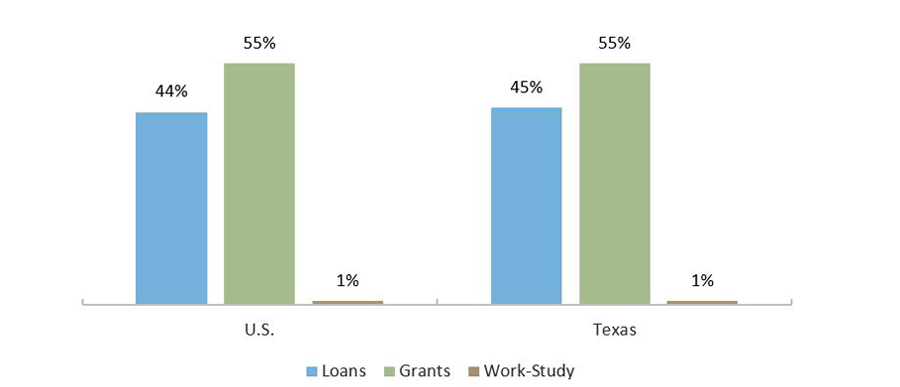

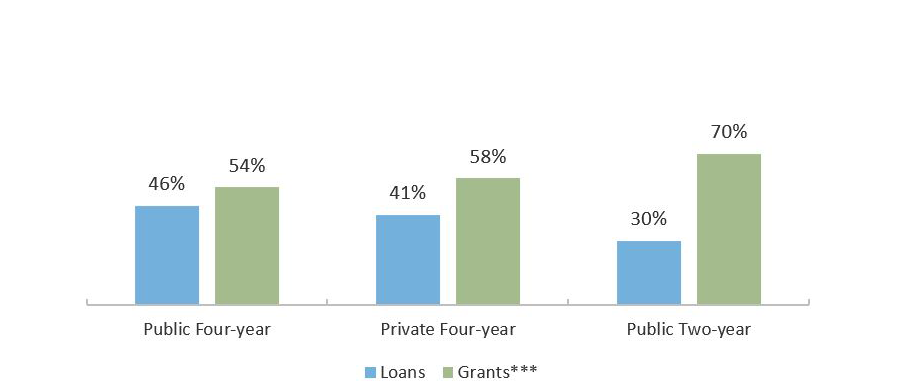

Nearly Half of Aid is in the Form of Loans

Direct* Student Aid by Type (AY 2018-2019)

* Direct student aid includes aid that is generally available, goes directly to students, and derives from state and federal appropriations (including both FFELP and FDLP loans), plus institutional grants.

Sources: Aid in Texas: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2019 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2018/); Aid in the U.S.: The College Board. Trends in Student Aid 2019 (http://trends.collegeboard.org/).

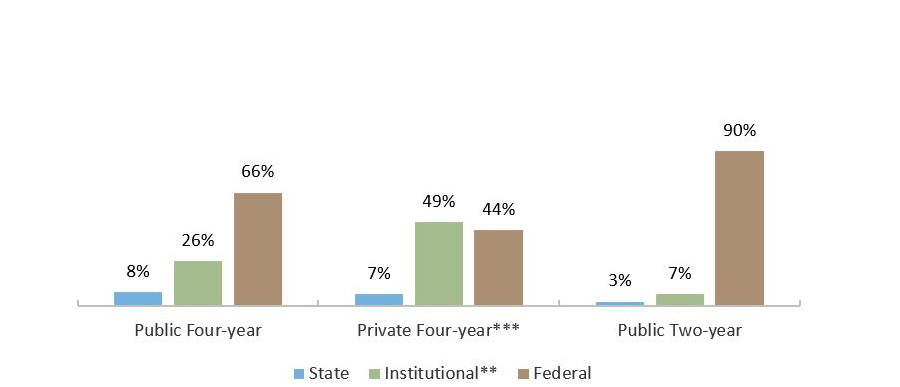

Texas Public Institution Students Are Most Heavily Dependent on Federal Student Aid

Direct Student Aid by Source in Texas, by Sector (AY 2018-2019*)

Direct Student Aid From All Sources by Type in Texas, by Sector (AY 2018-2019*)

* Direct student aid includes aid that is generally available, goes directly to students, and derives from state and federal appropriations (including both FFELP and FDLP loans), plus institutional grants. Comparable aid data for the private for-profit (proprietary) sector is unavailable. Work-study aid is not included in this chart. It accounted for less than one percent of direct student aid in all sectors. Totals may not add to 100 percent due to rounding.

** Tuition exemptions and waivers are included in institutional aid for the public sectors.

*** Data on tuition exemptions and waivers is included in the Grants category.

Sources: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2019 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2018/).

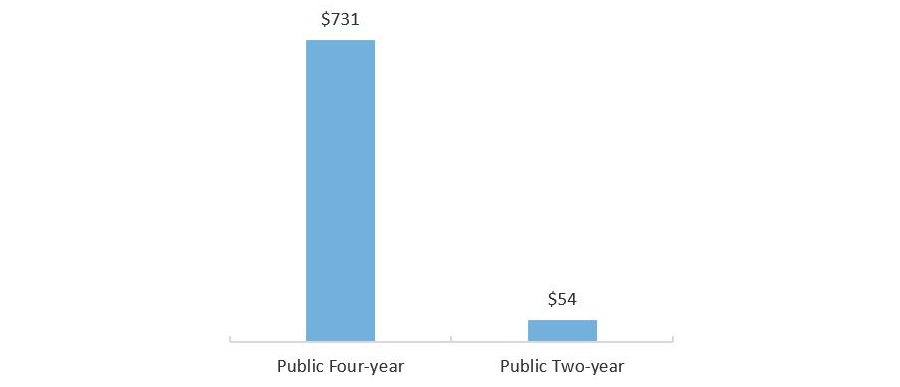

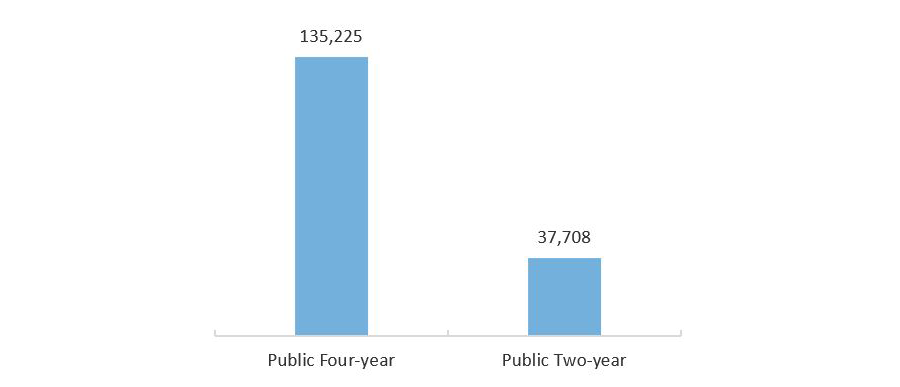

Students at Public Institutions in Texas Benefited from $785 Million in Exemptions and Waivers

FY 2019 Total Exemptions and Waivers Dollars, in Millions

FY 2019 Number of Recipients of Exemptions and Waivers

Sources: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2019 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2018/).

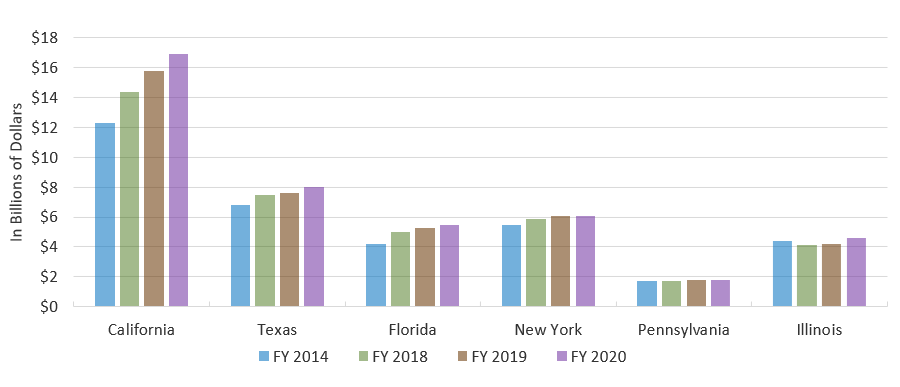

States Have Increased Support for Higher Education Over the Past Five Years

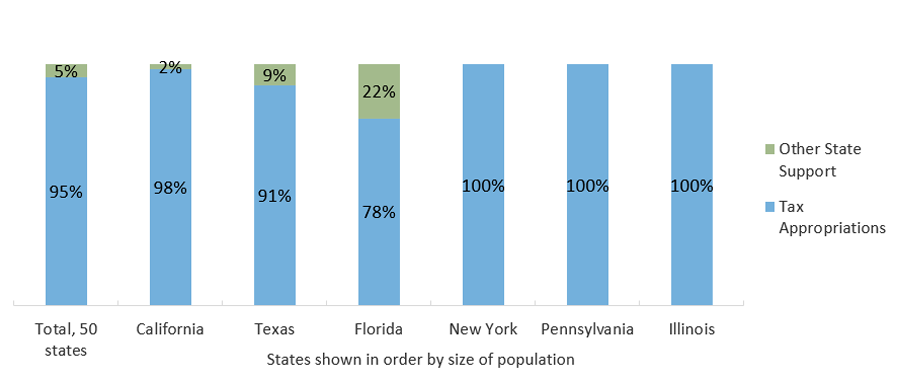

Percentage of State Higher Education Support by Type and State, FY 2020

State Fiscal Support for Higher Education, by State and Year, in 2020 Dollars

Sources: Illinois State University College of Education, Grapevine survey on state fiscal support for higher education, 2019-20 (https://education.illinoisstate.edu/grapevine/tables/).

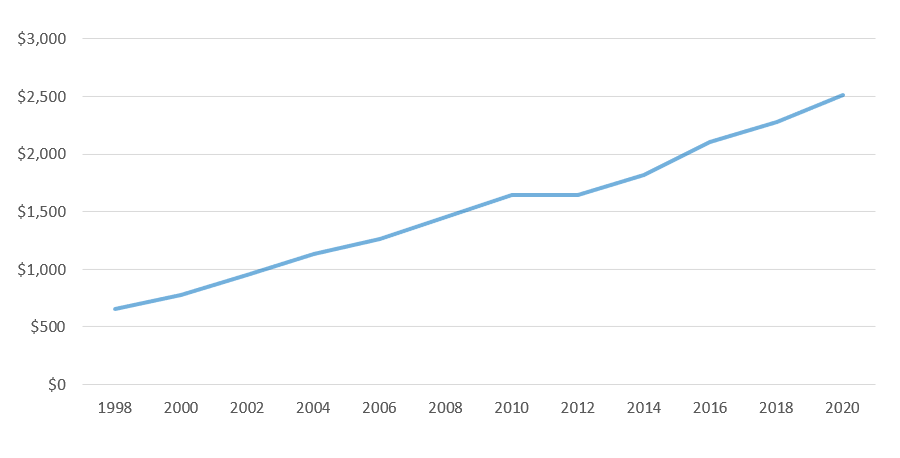

Community College Total Tax Revenue Has Increased Over Time

Estimated Total Tax Revenue of Texas Community Colleges, by Year, in Millions of Dollars (Adjusted to 2020 Dollars)

Note: Some community college districts have a mandatory tax rate freeze for certain citizens. The above figures are estimates based on projected tax rates and district valuation, not the actual amount collected by the district.

Sources: Texas Association of Community Colleges (TACC), Tax & Valuation Survey Results (https://tacc.org/tacc/college-data); Texas Association of Community Colleges (TACC), Property Taxes at Texas Community Colleges, July 2017 (https://tacc.org/sites/default/files/documents/2018-08/property_tax_071717.pdf).

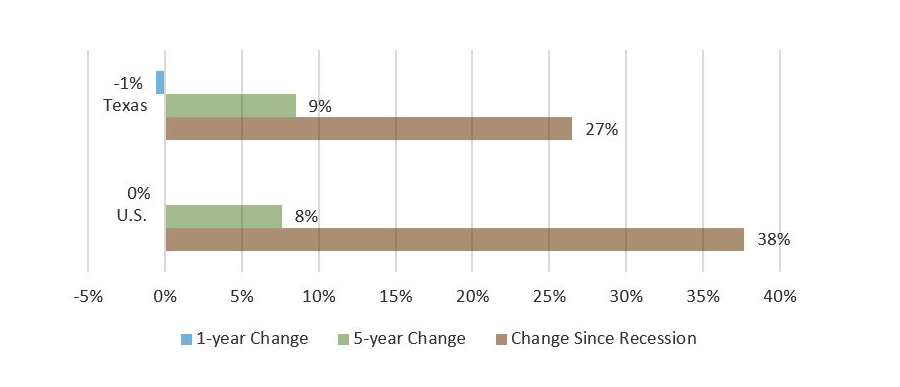

Net Tuition Revenue for Texas Public Higher Education Has Increased 27 Percent Since the Recession

Percent Change in Public Higher Education Net Tuition Revenue Per Full-Time Equivalent Student (Constant Adjusted 2019 Dollars)

Sources: State Higher Education Executive Officers Association (SHEEO), State Higher Education Finance: FY 2019 (https://shef.sheeo.org/wp-content/uploads/2020/04/SHEEO_SHEF_FY19_Report.pdf).

State Spending Per Public Higher Education Student is 22 Percent Lower in Texas Than It Was 10 Years Ago

Percent Change in State Spending Per Student in Public Higher Education, Inflation Adjusted, 2008-2018