State of Student Aid in Texas – 2022

Section 9: Student Financial Wellness

- Recent Studies of Food Security Amongst College Students find Similar, High Levels of Food Insecurity

- Longitudinal Study of College Students Reveals Fluid Pattern of Food Security

- Less Than Half of Students Were Aware That Their College Has a Food Pantry

- Almost Half of Community College Students are Housing Insecure

- More Than Half of Students Have Concerns About Affording College

- The Majority of College Students Would Have Trouble Getting $500 to Meet an Unexpected Need

- Half of Students Express Concern About Affording Monthly Expenses; Most are Running Out of Money at Least Once Annually

- More Than Two-Thirds of Students are Less Than Confident They Can Pay Off the Debt Acquired

- Half of Community College Students Do Not Pay Off Their Credit Card Balance Each Month

- Over a Third of Students Report Selling Belongings to Make Ends Meet

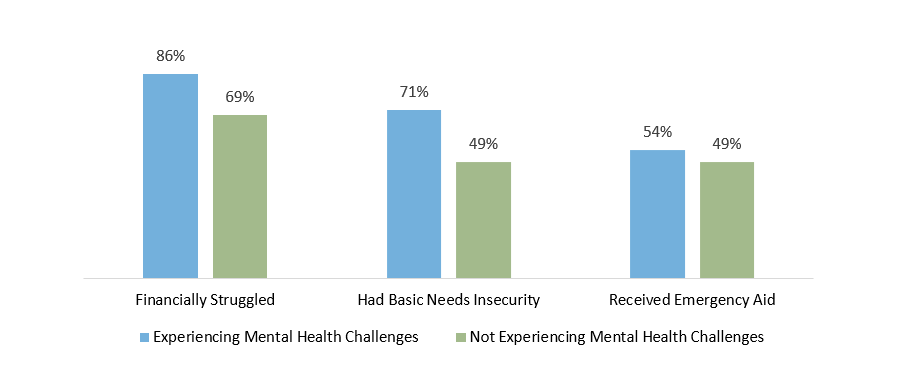

- Students Who Experienced Mental Health Struggles Were More Likely to Also Experience Financial Struggles

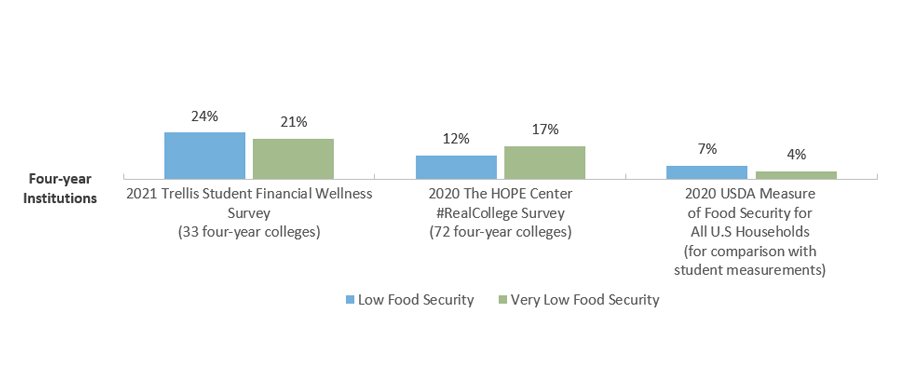

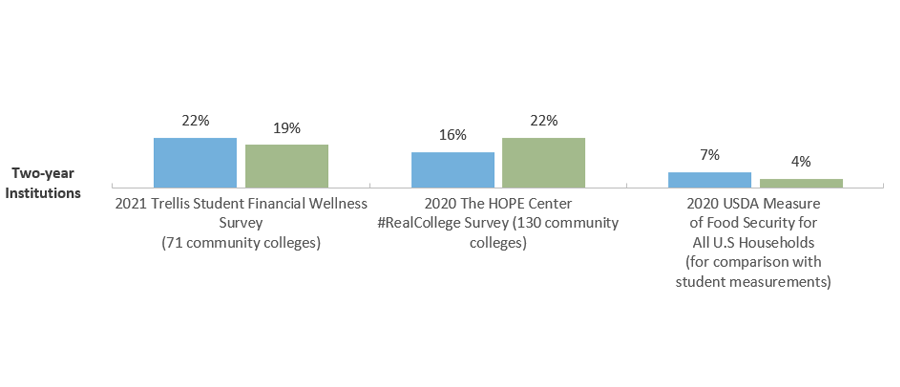

Recent Studies of Food Security Amongst College Students Find Similar, High Levels of Food Insecurity

Recent Studies of Food Security Among College Students Using the U.S. Department of Agriculture Scale

Note: The Trellis survey used the condensed six-question food security scale while the other surveys used the 10-question version.

Sources: United States Department of Agriculture (USDA). 2017. Definitions of food security. (https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/definitions-of-food-security/); Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables); Baker-Smith, C. Coca, V. Goldrick-Rab, S. Looker, E. Richardson, B. & Williams, T. (2021). #RealCollege 2021: Basic Needs Insecurity During the Ongoing Pandemic. The HOPE Center for College, Community, and Justice. (https://hope4college.com/wp-content/uploads/2020/02/2021_RealCollege_Survey_Report.pdf); U.S. Department of Agriculture, Economic Research Service. Food Security in the U.S. (https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/key-statistics-graphics/).

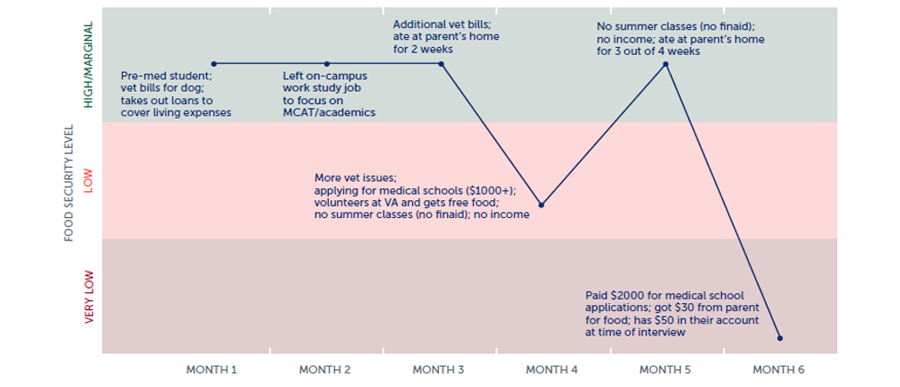

Longitudinal Study of College Students Reveals Fluid Pattern of Food Security

* Researchers are unable to rule out the possibility that declining food security may be explained, in part, by the subjects becoming more comfortable discussing this sensitive topic with interviewers.

Sources: Cornett, A., & Webster, J. (2020). Longitudinal Fluidity in Collegiate Food Security: Disruptions, Restoration, and Its Drivers. Trellis Company. Retrieved from: https://www.trelliscompany.org/wp-content/uploads/2020/02/Research-Brief_FSS_Longitudinal-Fluidity.pdf; Fernandez, C., Webster, J., & Cornett, A. (2019). Studying on Empty: A Qualitative Study of Low Food Security among College Students. Trellis Company. Retrieved from: https://www.trelliscompany.org/wp-content/uploads/2019/09/Studying-on-Empty.pdf.

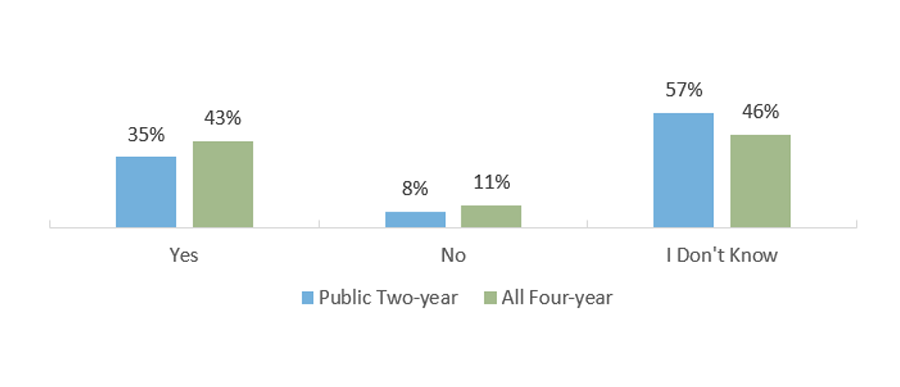

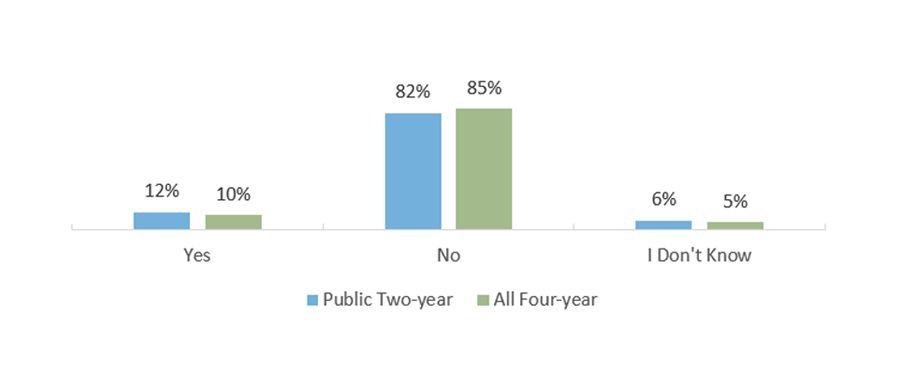

Less Than Half of Students Were Aware That Their College Has a Food Pantry

Q90: Does your school have a food pantry or food closet on campus?*

Q91: Have you visited a food pantry, on or off campus, since January 1, 2021?

* Analysis in this table excludes institutions that did not have a food pantry or food closet at the time the survey was implemented.

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables).

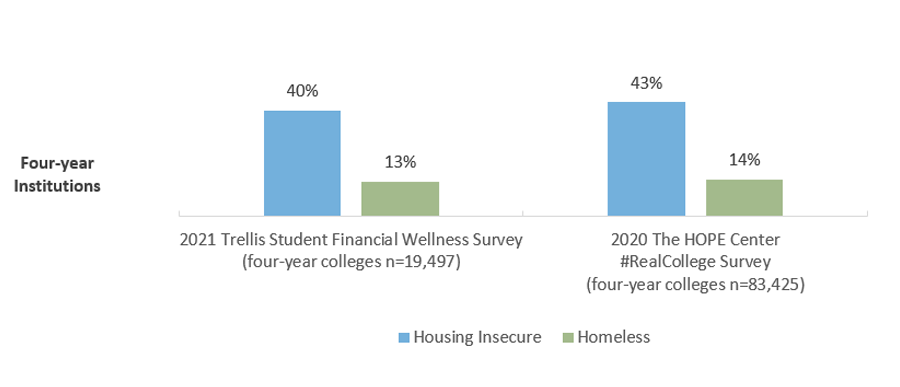

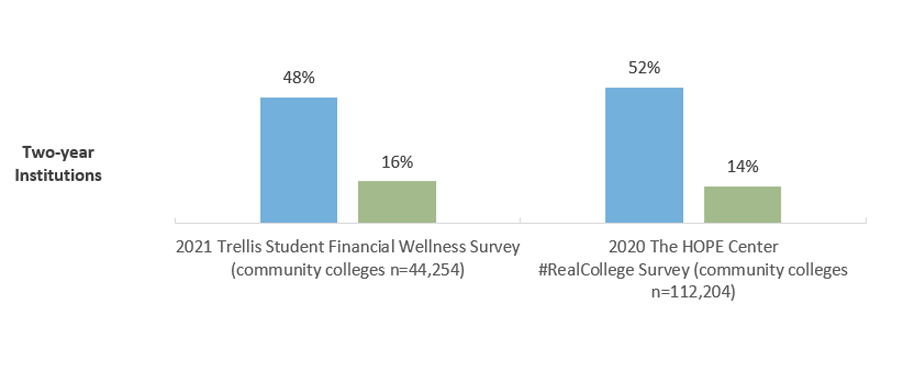

Almost Half of Community College Students are Housing Insecure

Recent Studies of Housing Security and/or Homelessness Among College Students within Prior Twelve Months

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables); #RealCollege 2021: Basic Needs Insecurity During the Ongoing Pandemic. The HOPE Center for College, Community, and Justice. (https://hope4college.com/wp-content/uploads/2020/02/2021_RealCollege_Survey_Report.pdf; U.S. News and World Report (February 27, 2018). A New Focus on College Campuses: Ending Housing Insecurity. https://www.usnews.com/news/education-news/articles/2018-02-27/campus-focus-on-solving-housing-insecurity-helping-homeless-students.

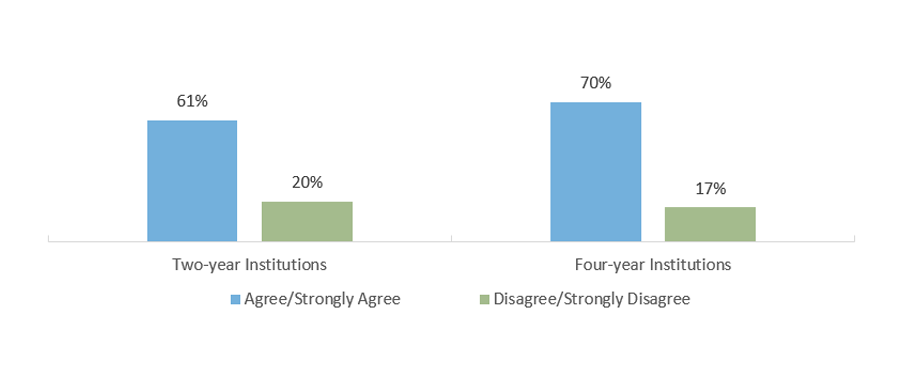

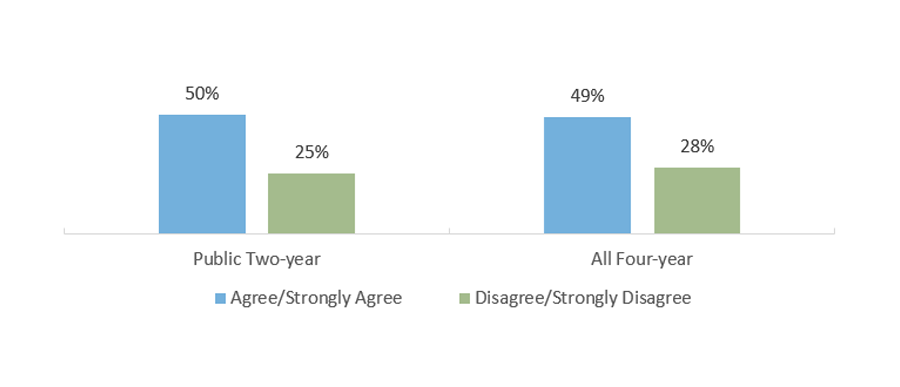

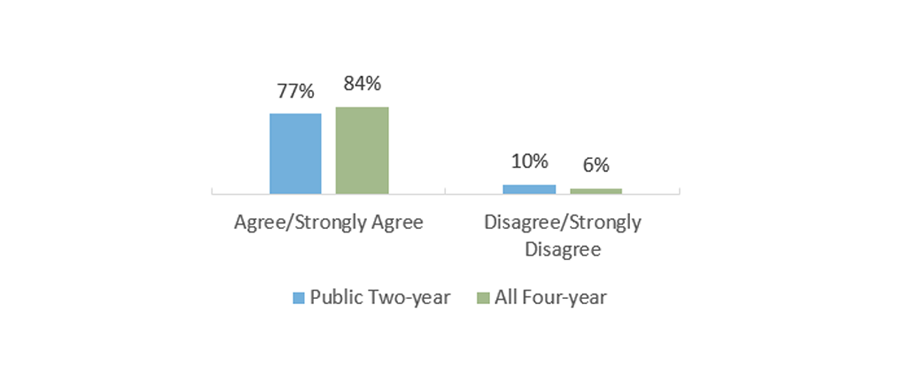

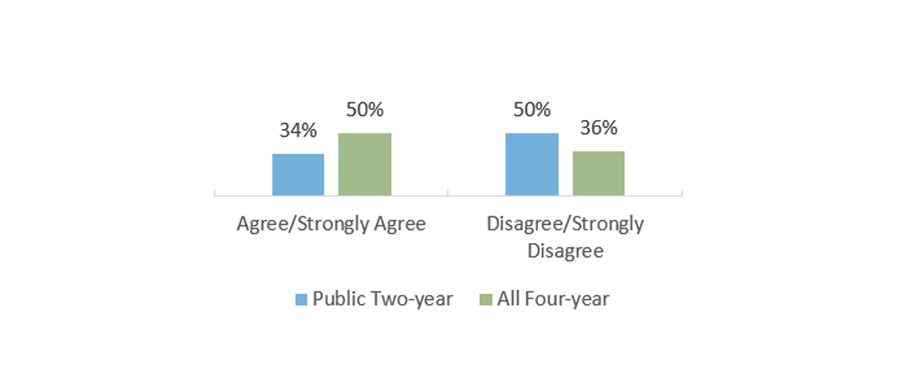

More Than Half of Students Have Concerns About Affording College

Q49: I worry about having enough money to pay for school.*

Q50: I know how I will pay for college next semester.*

Note: Trellis’ Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2021 implementation, 104 colleges in 25 states participated – 71 community colleges and 33 four-year institutions. There were 44,254 respondents attending public two-year institutions and 19,497 respondents attending four-year institutions. The results are not nationally representative.

* Responses indicating ‘Neutral’ are not shown

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables).

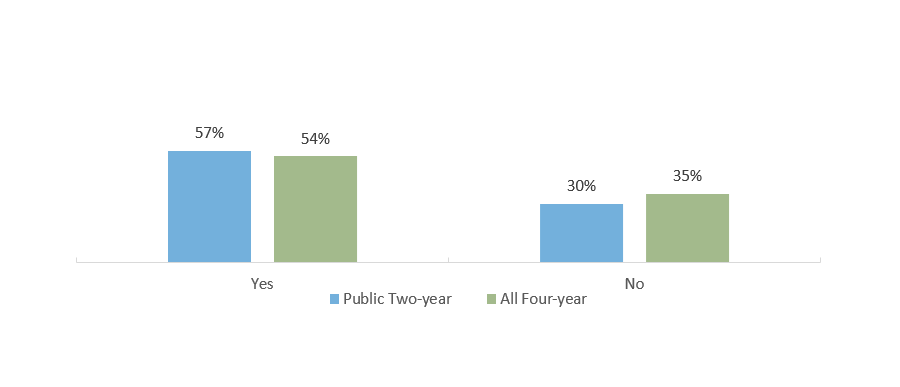

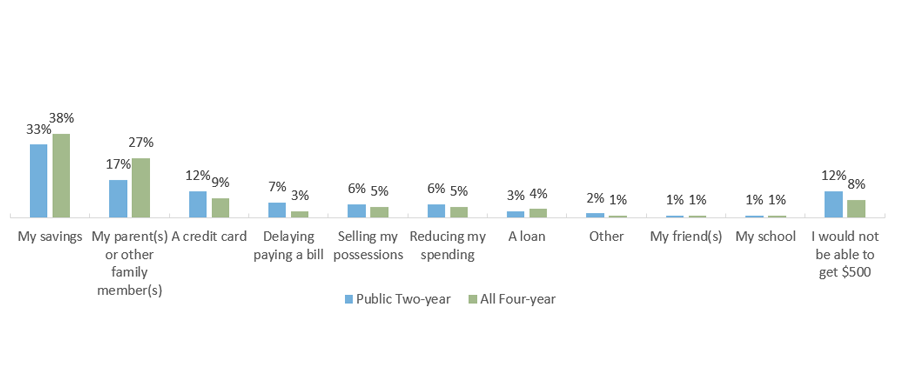

The Majority of College Students Would Have Trouble Getting $500 to Meet an Unexpected Need

Q41: Would you have trouble getting $500 in cash or credit in order to meet an unexpected need within the next month?*

Q42: Imagine that you had to pay a $500 cost unexpectedly in the next month. In this situation, which of the following resources would you turn to first?

Note: Trellis’ Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2021 implementation, 104 colleges in 25 states participated – 71 community colleges and 33 four-year institutions. There were 44,254 respondents attending public two-year institutions and 19,497 respondents attending four-year institutions. The results are not nationally representative.

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables).

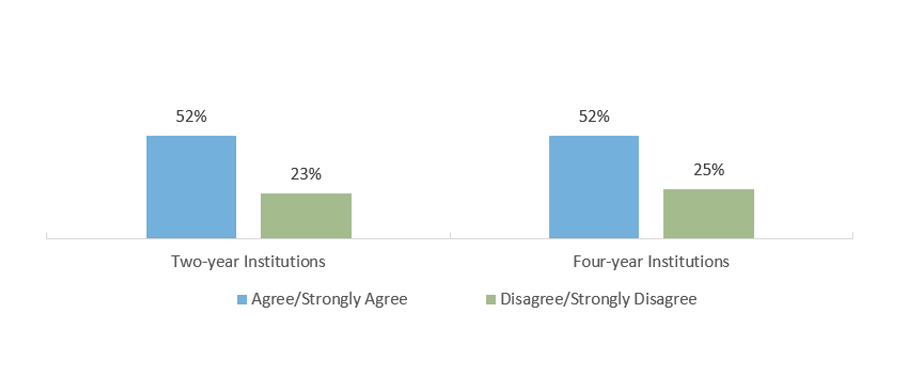

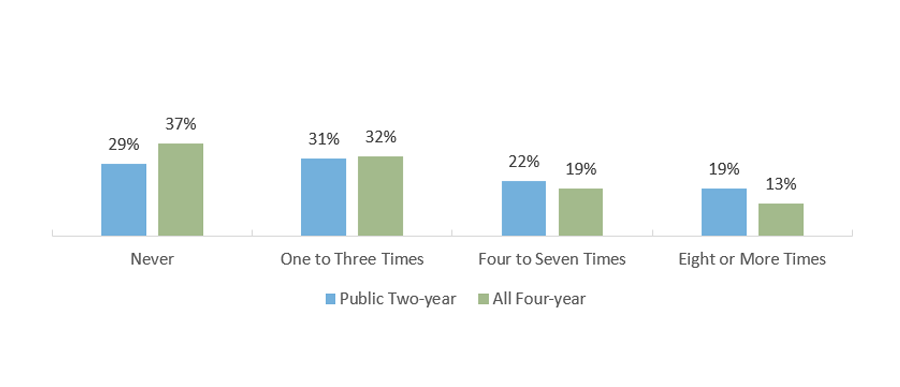

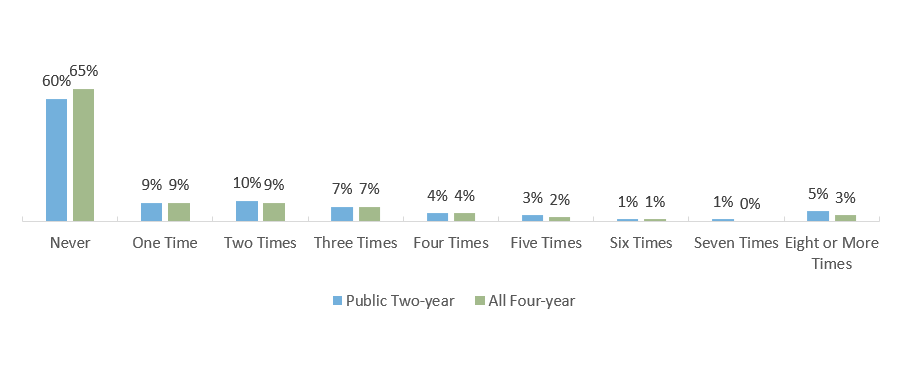

Half of Students Express Concern About Affording Monthly Expenses; Most are Running Out of Money at Least Once Annually

Q48: I worry about being able to pay my current monthly expenses.*

Q43: In the past 12 months, how many times did you run out of money?

Note: Trellis’ Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2021 implementation, 104 colleges in 25 states participated – 71 community colleges and 33 four-year institutions. There were 44,254 respondents attending public two-year institutions and 19,497 respondents attending four-year institutions. The results are not nationally representative.

* Responses indicating ‘Neutral’ are not shown

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables).

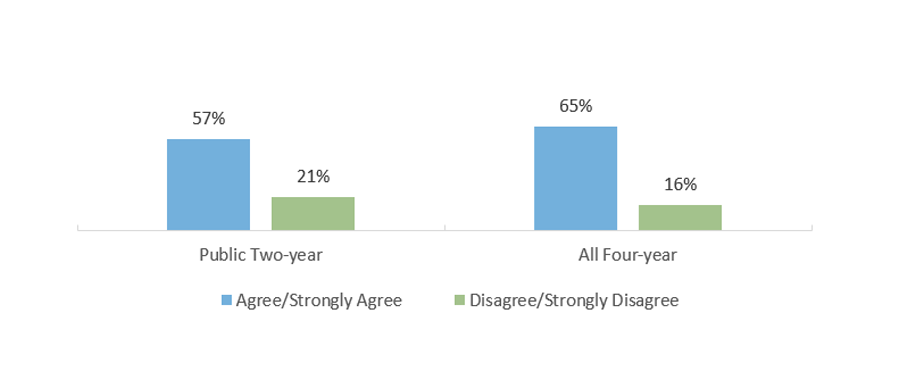

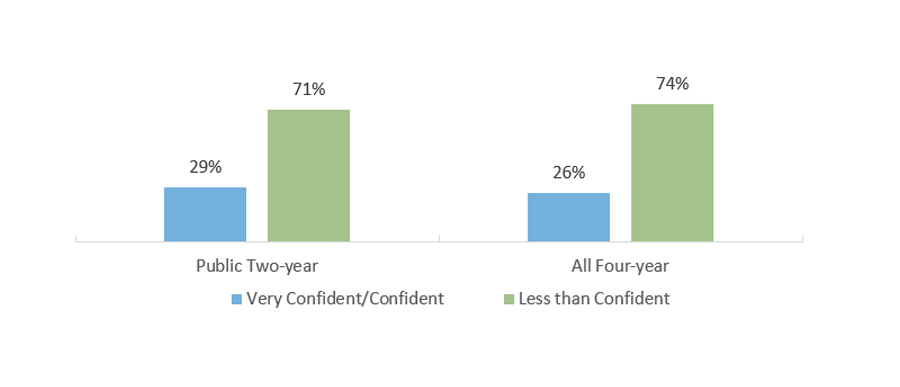

More Than Two-Thirds of Students Are Less Than Confident They Can Pay Off the Debt Acquired

Q75: I have more student loan debt than I expected to have at this point. (of those who indicated having a student loan they took out for themselves)*

Q76: How confident are you that you will be able to pay off the debt acquired while you were a student? (of those who indicated having a student loan they took out for themselves)

Note: Trellis’ Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2021 implementation, 104 colleges in 25 states participated – 71 community colleges and 33 four-year institutions. There were 44,254 respondents attending public two-year institutions and 19,497 respondents attending four-year institutions. The results are not nationally representative.

* Of those who said they had borrowed student loans to pay for college; responses indicating ‘Neutral’ are not shown

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables).

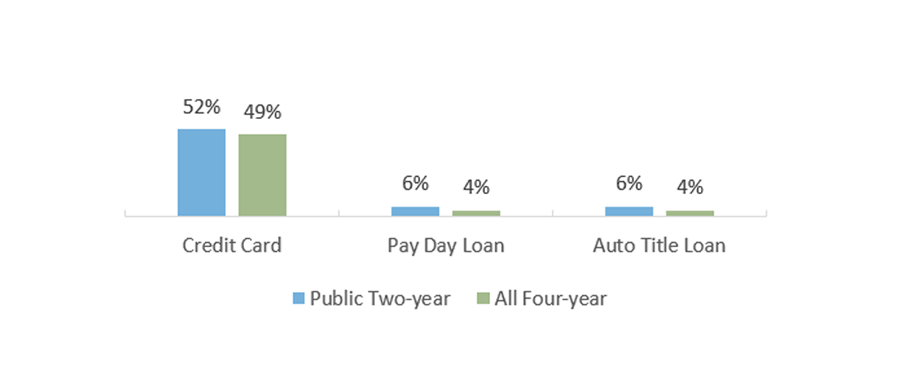

Half of Community College Students Do Not Pay Off Their Credit Card Balance Each Month

Q61: Since January 1, 2021, have you used the following borrowing sources? Responses who answered ‘Yes’

Q66: I always pay my credit card bill on time.*

Q67: I fully pay off my credit card bill each month.*

Note: Trellis’ Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2021 implementation, 104 colleges in 25 states participated – 71 community colleges and 33 four-year institutions. There were 44,254 respondents attending public two-year institutions and 19,497 respondents attending four-year institutions. The results are not nationally representative.

* Of those who said they had used a credit card since the beginning of the year; responses indicating ‘Neutral’ are not shown.

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables).

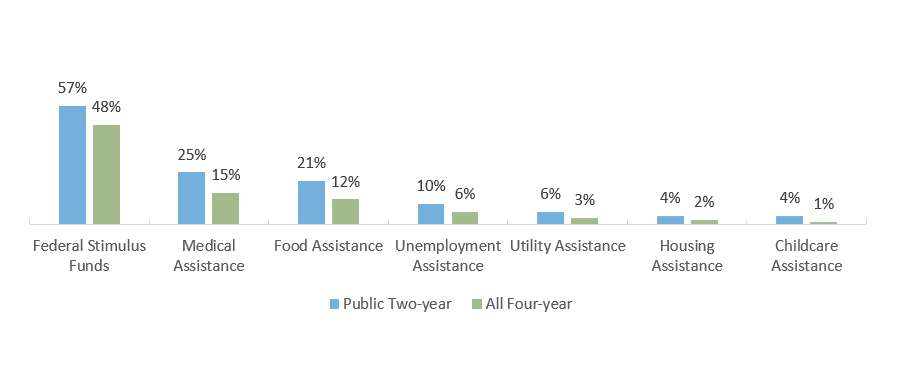

Over a Third of Students Report Selling Belongings to Make Ends Meet

Q54-60: Public assistance use, by assistance type

Q70: Since January 1, 2021, approximately how many times did you sell your belongings to make ends meet?

Note: Trellis’ Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2021 implementation, 104 colleges in 25 states participated – 71 community colleges and 33 four-year institutions. There were 44,254 respondents attending public two-year institutions and 19,497 respondents attending four-year institutions. The results are not nationally representative.

Sources: Fletcher, C., Cornet, A., & Webster, J. Student Financial Wellness Survey: Fall 2021 (unpublished tables); Federal Stimulus Funds: U.S. Department of the Treasury. Economic Impact Payments (https://home.treasury.gov/policy-issues/coronavirus/assistance-for-american-families-and-workers/economic-impact-payments).

Students Who Experienced Mental Health Struggles Were More Likely to Also Experience Financial Struggles

Financial Challenges by Mental Health Status