State of Student Aid in Texas – 2018

Section 9: Student Financial Wellness

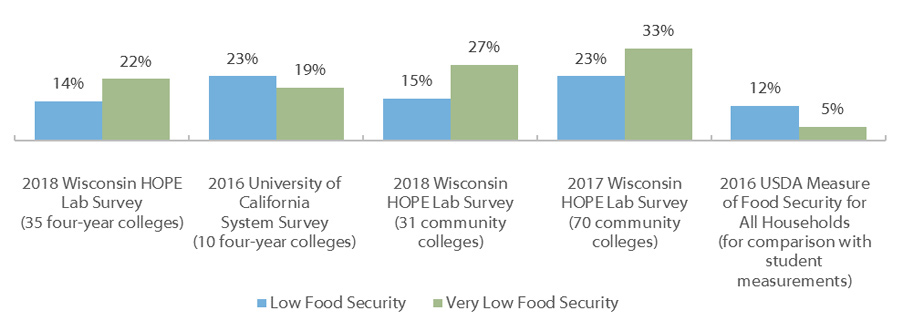

Recent Studies of Food Security Amongst College Students Using the U.S. Department of Agriculture Scale

A growing body of research has explored the degree to which postsecondary students are struggling to meet their basic needs, such as housing and food. While more research is needed to explore the extent to which basic needs insecurity affects student success, it is reasonable to assume that students who struggle with hunger, nutrition, and/or finding safe shelter will have a more difficult path to earning a degree. Providing and connecting resources (e.g., food pantries, financial education, emergency aid, transportation vouchers) to these students may affect their success in college.

The measurement tool designed by the United States Department of Agriculture (USDA) defines low food security as “reports of reduced quality, variety, or desirability of diet” and very low food security as “reports of multiple indications of disrupted eating patterns and reduced food intake.” While no nationally representative research is available for food insecurity among college students, a number of studies have found similar, troubling levels of food insecurity.

The most recent study, a 2018 survey of students attending 66 colleges conducted by the Wisconsin HOPE lab, found that 36 percent of students at four-year colleges, and 42 percent of students at community colleges experience low or very low food security. The survey was open to any college that wanted to participate. The 66 colleges were mostly public, two-year and four-year, and from the Northeast and South regions of the U.S. The results were similar to results from two previous rounds of this survey.

Sources: United States Department of Agriculture (USDA). 2017. Definitions of food security. https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/definitions-of-food-security/; Goldrick-Rab, S., Richardson, J., Schneider, J., Hernandez, A., & Cady, C. (2018). Still Hungry and Homeless in College. Wisconsin HOPE Lab. http://wihopelab.com/publications/Wisconsin-HOPE-Lab-Still-Hungry-and-Homeless.pdf; Goldrick-Rab, S., Richardson, J., & Hernandez, A. (2017). Hungry and Homeless in College: Results from a National Study of Basic Needs Insecurity in Higher Education. Wisconsin HOPE Lab. http://www.wihopelab.com/publications/Hungry-and-Homeless-in-College-Report.pdf; Martinez, S., Maynard, K., & Ritchie, L. (2016). Student food access and security study. University of California Global Food Initiative. http://regents.universityofcalifornia.edu/regmeet/july16/e1attach.pdf; Alisha Coleman-Jensen, Matthew P. Rabbitt, Christian A. Gregory, and Anita Singh. 2017. Household Food Security in the United States in 2016, ERR-237, U.S. Department of Agriculture, Economic Research Service. https://www.ers.usda.gov/webdocs/publications/84973/err-237.pdf?v=42979.

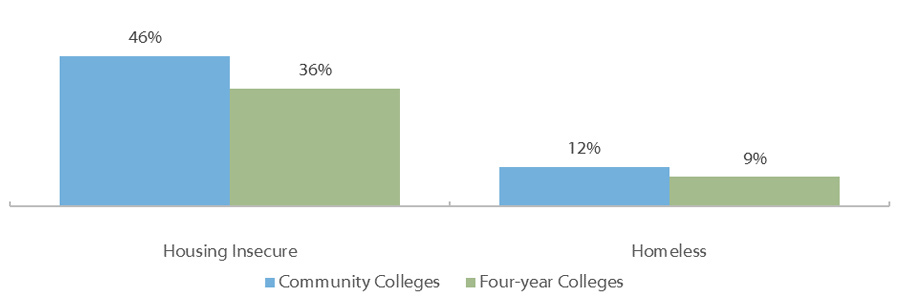

Results from a 2018 Wisconsin HOPE Lab Survey of Basic Needs: Housing Security and/or Homelessness within Prior 12 Months at Community and Four-Year Colleges

A recent report by the Wisconsin HOPE lab has found high levels of housing insecurity and homelessness among college students. Being homeless or “without a place to live, often residing in a shelter, an automobile, an abandoned building, or outside” can make an already challenging college experience even more difficult. Housing insecurity, including inability to pay full housing costs and moving in with others due to financial issues, is less severe, but can also make the college experience difficult.

The Wisconsin HOPE lab conducted a third round of its housing and food security survey in 2018. The survey was open to any college that wanted to participate. The 66 participating colleges were mostly public, two-year and four-year, and from the Northeast and South regions of the U.S. The results were similar to results from the two previous rounds of this survey.

In the 2018 survey, researchers found that 46 percent of community college students and 36 percent of four-year college students experienced housing insecurity in the previous 12 months. Additionally, the study found that 12 percent of community college students and nine percent of four-year students experienced homelessness in that same time period. As the cost of college rises, basic needs security may become a barrier to success for more students. Some colleges are addressing housing issues with emergency grants, temporary housing, and partnerships with local organizations to provide rental assistance to students

Sources: Goldrick-Rab, S., Richardson, J., Schneider, J., Hernandez, A., & Cady, C. (2018). Still Hungry and Homeless in College. Wisconsin HOPE Lab. http://wihopelab.com/publications/Wisconsin-HOPE-Lab-Still-Hungry-and-Homeless.pdf; U.S. News and World Report (February 27, 2018). A New Focus on College Campuses: Ending Housing Insecurity. https://www.usnews.com/news/education-news/articles/2018-02-27/campus-focus-on-solving-housing-insecurity-helping-homeless-students.

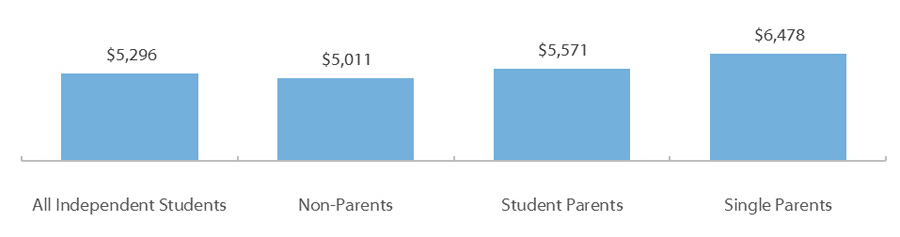

Average Unmet Need* For AY 2011-12 Among Independent College Students Nationally by Dependency, Parental, and Marital Status

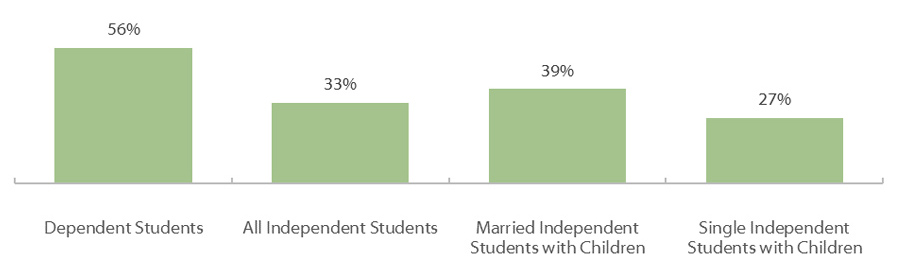

Percent Completing a Degree or Certificate Within Six Years (2011-12)

Taking care of children while trying to earn a degree can be challenging. According to an analysis of Academic Year (AY) 2011-12 U.S. Department of Education data by the Institute for Women’s Policy Research, around 4.8 million students (26% of all students) are parents with dependent children. Students with children have, on average, around $560 more in unmet need* than other independent students, and single parents have almost $1,500 more in unmet need.* Students who are single parents have a lower six-year graduation rate (27%) than other independent students (33%), much lower than married students with children (39%). Nearly 8 in 10 single parents attending college are single mothers.

Most independent students worked while attending college in AY 2011-12 (more than two thirds), and 31 percent of independent students worked full time while enrolled. While working can help relieve financial stress, working an excessive number of hours while enrolled in college can hinder class attendance and studying, and can reduce the chances of graduating.

* Unmet need is the gap that remains between a student’s resources and his/her total cost of attendance even after accounting for grants, federal loans, and expected family contribution (the formulaically-determined amount that the student can be expected to pay out of pocket).

Sources: Understanding the New College Majority: The Demographic and Financial Characteristics of Independent Students. (February 2018). Institute for Women’s Policy. Retrieved at: https://iwpr.org/wp-content/uploads/2018/02/C462_Understanding-the-New-College-Majority_final.pdf.

Spring 2018 Student Financial Wellness Survey

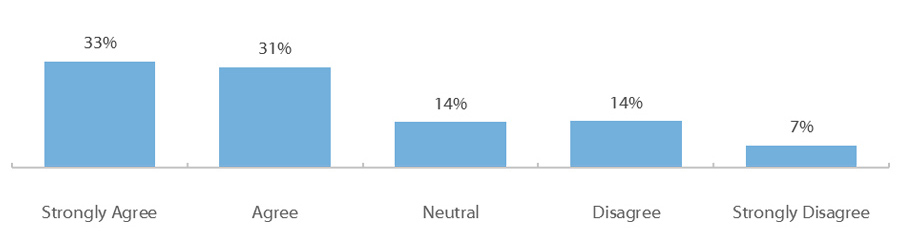

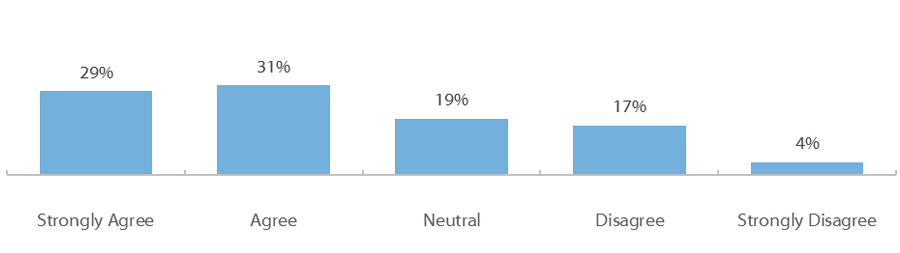

Q47: I worry about having enough money to pay for school.

Spring 2018 Student Financial Wellness Survey

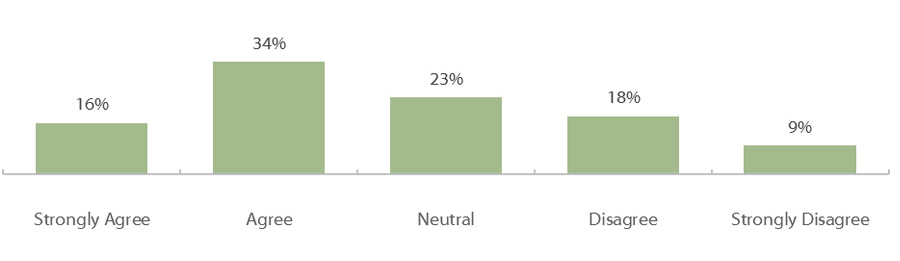

Q48: I know how I will pay for college next semester.

In Trellis’ spring 2018 Student Financial Wellness Survey, many students surveyed signaled concerns about being able to afford college. Almost two in three respondents either agreed (31 percent) or strongly agreed (33 percent) that they worry about having enough money to pay for school.

Only half of respondents either agreed or strongly agreed that they knew how they would pay for college next semester, while almost a quarter of students (22 percent) disagreed or strongly disagreed. Confidence in being able to pay for the next semester varied by gender. Female respondents indicated that they worry about paying for school and did not know how they would pay for the next semester of college more frequently than male respondents.

Sources: Klepfer, K., Ashton, B., Bradley, D., Fernandez, C., Wartel, M., & Webster, J. (June 2018). Student Financial Wellness Survey: Spring 2018 Report. Trellis Research. Retrieved from: https://www.trelliscompany.org/student-finance-survey/.

Spring 2018 Student Financial Wellness Survey

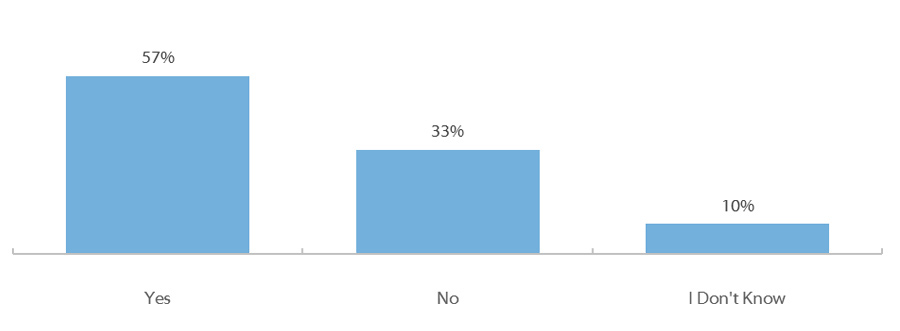

Q40: Would you have trouble getting $500 in cash or credit in order to meet an unexpected need within the next month?

For students on tight budgets, persisting in school often depends on financial plans that go smoothly, as even modest disruptions due to accidents, illness, or unanticipated expenses can impede success. Cash-strapped students face these contingencies with fewer options than their more affluent peers, often engaging in extreme frugality and untenable work schedules that threaten their health and diminish their learning experiences. For students who are financially vulnerable, a relatively small expense can force difficult decisions around staying enrolled in college.

Over half of respondents (57 percent) in Trellis’ Student Financial Wellness Survey indicated they would have trouble getting $500 in cash or credit in an emergency. Students who reported they would have trouble getting $500 cash or credit for an emergency responded at higher rates that they worry about having enough money to pay for school and at lower rates that they know how they will pay for college next semester compared to those who reported no issues to accessing $500 for an emergency.

Female respondents reported at higher rates than males that they would have trouble meeting a $500 emergency. Interventions that address issues more common among women, such as access to daycare, may alleviate some of these concerns. Additional research to better determine gender-specific financial issues would help target appropriate services. Given students’ financial vulnerability and lower confidence in paying for college, student success initiatives could benefit from financial components such as emergency aid programs that provide small dollar grants to students in financial emergencies. These types of interventions have improved student retention.

Source: Klepfer, K., Ashton, B., Bradley, D., Fernandez, C., Wartel, M., & Webster, J. (June 2018). Student Financial Wellness Survey: Spring 2018 Report. Trellis Research. Retrieved from: https://www.trelliscompany.org/student-finance-survey/; Kruger, K., Parnell, A., & Wesaw, A. 2016. “Landscape analysis of emergency aid programs.” National Association of Student Personnel Administrators (NASPA). https://www.naspa.org/images/uploads/main/Emergency_Aid_Report.pdf. Retrieved on 4/30/2018.

Spring 2018 Student Financial Wellness Survey

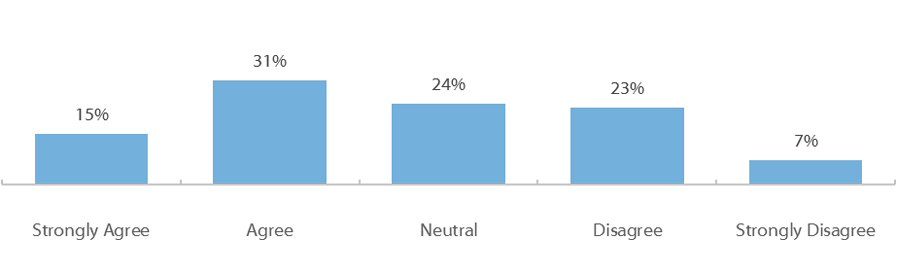

Q46: I worry about being able to pay my current monthly expenses.

Spring 2018 Student Financial Wellness Survey

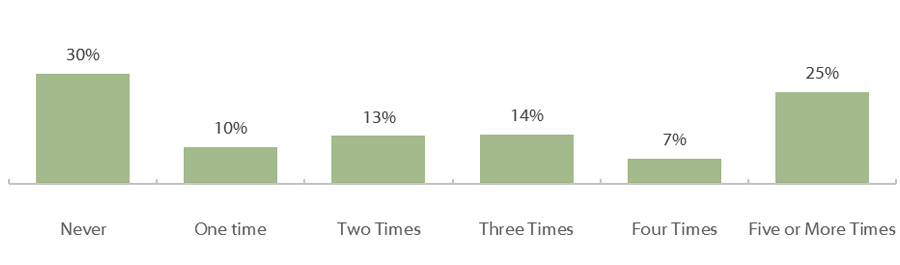

Q41: In the past 12 months, how many times did you run out of money?

Some of the anxiety around paying for school may be driven by students’ concern for their day-to-day expenses. Almost half of respondents in Trellis’ Student Financial Wellness Survey worried to some degree about paying for their current monthly expenses (46 percent agree or strongly agree).

It takes careful planning for students to meet their expenses and manage a limited, often uncertain, cash flow while attending school. The majority (70 percent) of respondents reported running out of money at least once in the past 12 months, and nearly half (46 percent) reported running out of money three or more times. A quarter of respondents reported running out of money five or more times over the past year. These students who ran out of money five or more times responded at higher rates that they worry about having enough money to pay for school and at lower rates that they know how they will pay for college next semester.

Sources: Klepfer, K., Ashton, B., Bradley, D., Fernandez, C., Wartel, M., & Webster, J. (June 2018). Student Financial Wellness Survey: Spring 2018 Report. Trellis Research. Retrieved from: https://www.trelliscompany.org/student-finance-survey/.

Spring 2018 Student Financial Wellness Survey

Q64: I have more student loan debt than I expected to have at this point (of respondents with student loans).

Spring 2018 Student Financial Wellness Survey

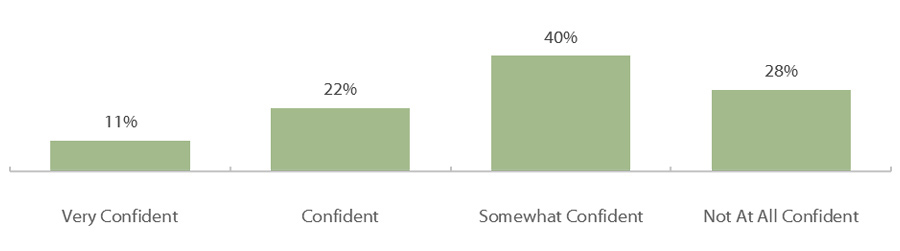

Q65: How confident are you that you will be able to pay off the debt acquired while you were a student (of respondents with student loans)?

Paying for college often involves piecing together money from a variety of sources, including federal, state, institutional, and private grants, family support, personal income, savings, and various loan products. Research indicates that half of all students borrow in their first year of college, and half of the remaining students borrow within six years of enrolling.

Estimating college expenses can be difficult, especially for students who are the first in their families to attend college. A large majority of respondents (60 percent) in Trellis’ Student Financial Wellness Survey who borrowed agreed or strongly agreed with the statement that they had more student loan debt than they expected at this point. Many students borrow with no confidence in their ability to repay. Twenty-eight percent of those who borrowed were not at all confident they would be able to pay off the debt acquired while they were a student, and an additional 40 percent were only somewhat confident.