State of Student Aid in Texas – 2020

Section 5: Grant Aid and Net Price in Texas

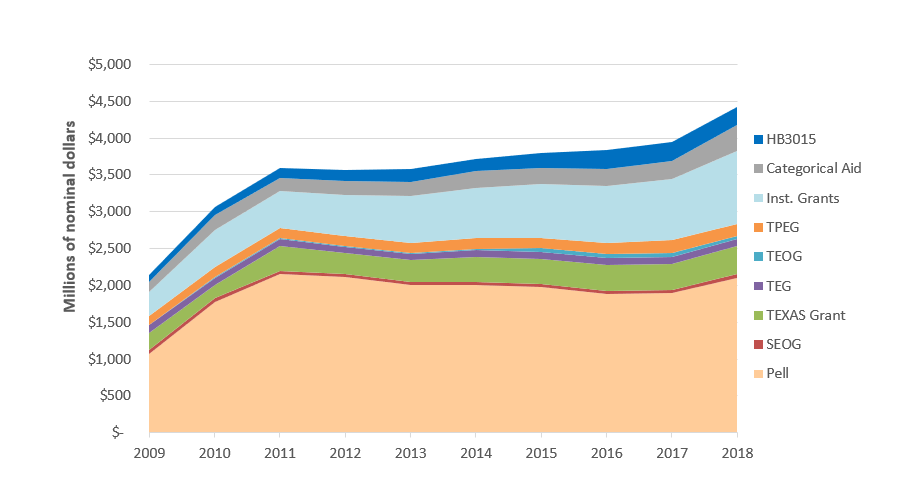

Total Grant Aid Awarded in Texas by Major Grant Program, by Fiscal Year (in Current Dollars)

The federal Pell Grant Program is the largest source of grant aid in Texas, awarding about 528,000 undergraduate students more than $2.1 billion in award year (AY) 2017-2018. Combined with the Federal Educational Opportunity Grant (SEOG), the federal government provided about half of the grant dollars in Texas.

The four largest state grant programs in Texas provided about 15 percent of the grant dollars in Texas in AY 2017-2018. The Towards EXcellence, Access, and Success (TEXAS) Grant is the largest of the state grant programs, disbursing over $383 million in AY 2016-2017. TEXAS Grants are available to baccalaureate students who meet a variety of financial and academic criteria, with priority consideration given to students who meet additional academic criteria and a priority filing deadline. The Texas Educational Opportunity Grant (TEOG) serves financially needy students at public two-year colleges, the Tuition Equalization Grant (TEG) is available to financially needy students at private, non-profit institutions, and the Texas Public Educational Opportunity Grant (TPEG) is awarded to needy public college and university students out of tuition set-asides.

Aid issued under HB 3015, which requires institutions to “set aside” at least 15 percent of all tuition charges exceeding $46 per semester credit hour (SCH) for financial aid to needy resident students, and institutional aid made up more than one quarter of grant aid dollars in Texas in AY 2017-2018. Almost $250 million in HB 3015 grants were awarded to about 106,000 students, and about $996 million in institutional grants were awarded to about 185,000 students in AY 2017-2018.

Sources: Aid in Texas: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2018 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2018/).

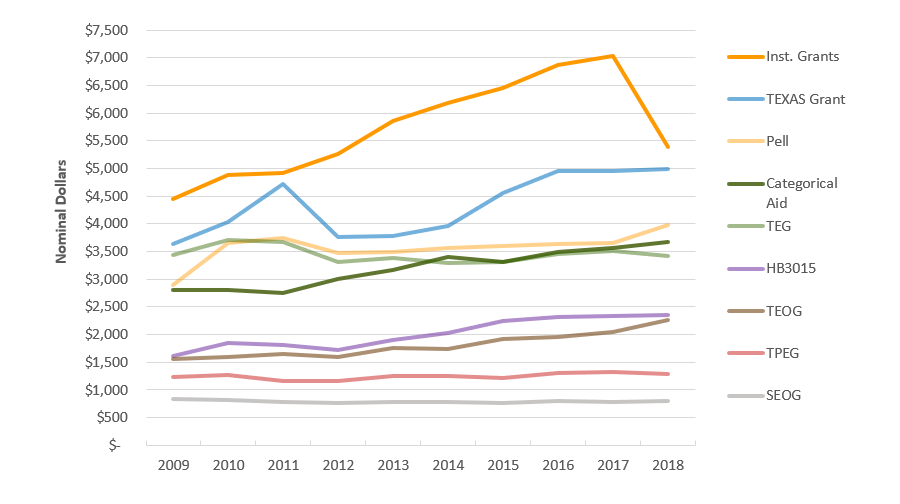

Average Grant Award in Texas by Major Grant Program, by Fiscal Year

(in Current Dollars)

The largest average grant award in Texas in fiscal year (FY) 2017-2018 (referenced as 2018 in the chart) was for institutional grants at $5,381, followed by the Towards EXcellence, Access, and Success (TEXAS) grant at $4,948. The average institutional grant dropped sharply in 2018 after increasing steadily for years. The TEXAS grant has generally increased over the years, but has held fairly level for the last three years. The other grant programs have mostly been level or seen incremental increases over the last ten years.

The average Pell grant increased nine percent, from $3,651 in AY 2016-2017 to $3,984 in AY 2017-2018. The maximum Pell grant for AY 2015-2016 was $5,775 and increased to $5,920 for AY 2017-2018. This $145 increase over the last two years is based on the Student Aid and Fiscal Responsibility Act (SAFRA), which provides for automatic changes to the maximum Pell grant based on changes in the Consumer Price Index (CPI), a common measure of inflation.

Sources: Aid in Texas: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2018 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2018/).

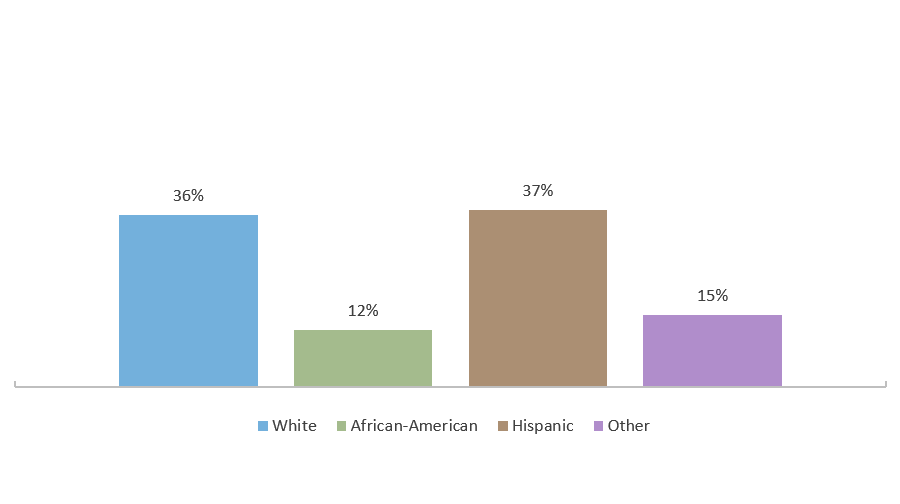

Fall 2017 Enrollment in Texas Higher Education, by Ethnicity

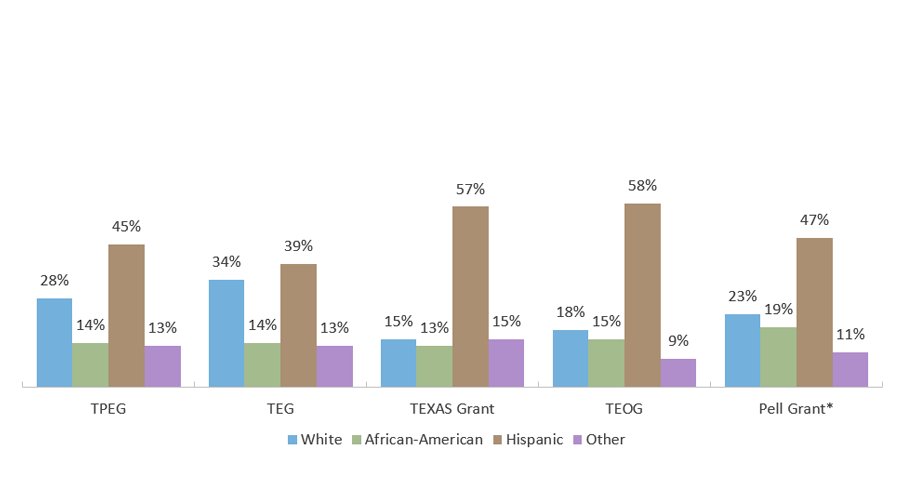

About 73 percent of Texas Educational Opportunity Grant (TEOG) and 70 percent of Toward EXcellence, Access, and Success (TEXAS) Grant recipients are either Hispanic or African-American. The Texas Public Educational Grant (TPEG) and Tuition Equalization Grant (TEG) serve somewhat fewer Hispanic and African-American students — 59 percent and 53 percent, respectively. The percentage of TPEG and TEG recipients who are Hispanic or African-American students has risen slowly over time, likely reflecting the steadily rising proportion of these students enrolled at public and private four-year colleges and universities.

Fiscal Year 2017-2018 Grant Program Recipients by Ethnicity

*Pell grant data did not disaggregate “Asian/Pacific Islander” from “Other”, so both are included in “Other”.

Sources: Enrollment by ethnicity: U.S. Dept of Education, National Center for Education Statistics, IPEDS (https://nces.ed.gov/ipeds/); Texas grant programs: THECB Financial Aid Database for Fiscal Year 2018 (special request, unpublished tables).

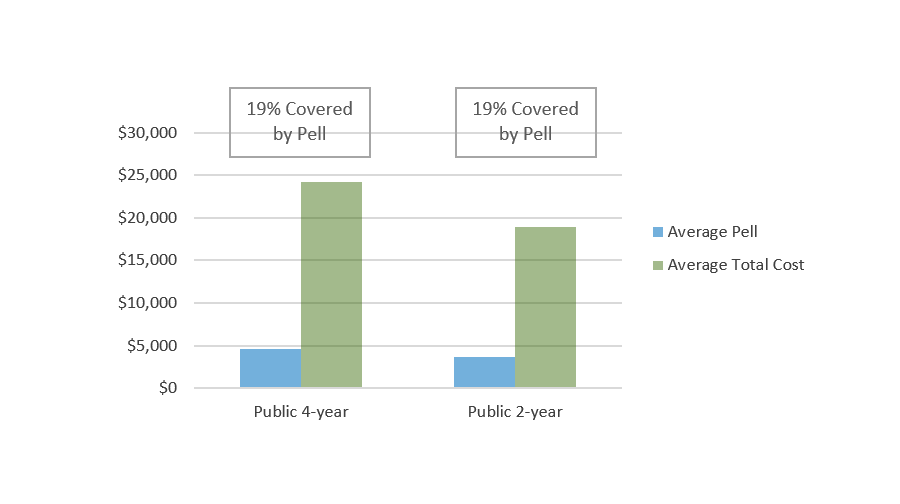

Total Cost of Attendance for Two Semesters Full-time Attendance at Texas Public Institutions Covered by Average Pell Grant Amount, by Sector

(AY 2018-2019)

The buying power of the federal Pell Grant, the largest grant program in the U.S. and in Texas, has declined over the last three decades. Designed to be the foundation of need-based grant aid, only undergraduates with significant financial need receive the Pell grant; however, in Award Year (AY) 2018–2019, the average Pell grant in Texas covered only 19 percent of the average cost of attendance (COA; tuition, fees, room, board, and other basic expenses) for eligible undergraduates at public four-year universities in Texas, and the same percentage of the average COA at public two-year colleges in Texas. While the average Pell grant tends to increase from one year to the next, these increases generally fail to keep pace with increases in the cost of college.

The maximum Pell grant for AY 2015–2016 was $5,775 and increased to $5,920 for AY 2017-2018. This $145 increase over the last two years is based on the Student Aid and Fiscal Responsibility Act (SAFRA), which provides for automatic changes to the maximum Pell grant based on changes in the Consumer Price Index (CPI), a common measure of inflation. Pell grant awards are determined according to a schedule that takes both COA and expected family contribution (EFC) into account. Pell grant awards increase for higher COAs and lower EFCs and decrease for lower COAs and higher EFCs. There is also a set maximum EFC beyond which a student cannot qualify for a Pell grant regardless of the COA; for AY 2018-2019, the maximum eligible EFC is $5,328.

Sources: Cost of attendance: U.S. Department of Education, National Center for Education Statistics, IPEDS Data Center (Author’s calculation: Total cost of full-time undergraduate attendance weighted by FTE in-state undergraduate enrollment) (http://nces.ed.gov/ipeds/datacenter/); Pell: U.S. Department of Education, Federal Student Aid Data Center, Programmatic Volume Reports (http://studentaid.ed.gov/about/data-center/student/title-iv); Maximum Pell: U.S. Department of Education, Federal Student Aid (https://studentaid.ed.gov/sa/types/grants-scholarships/pell).

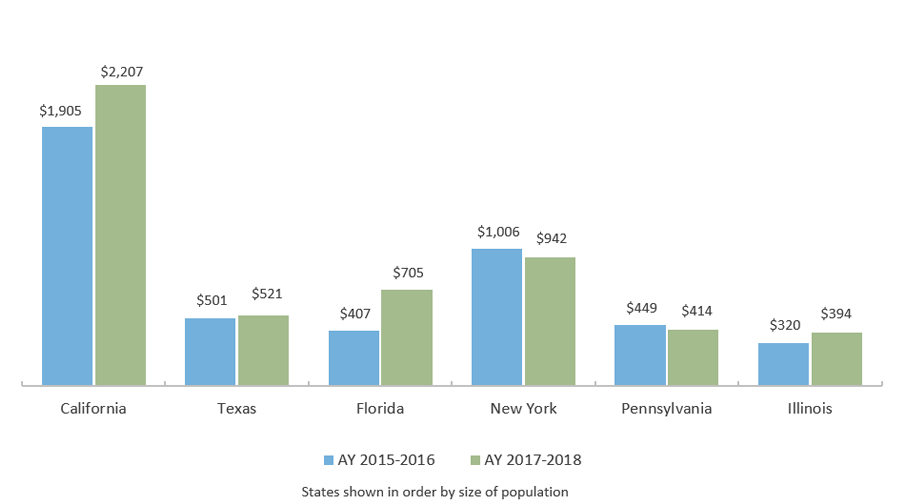

Total State Grant Aid (millions of current dollars)

In Award Year (AY) 1998–1999, Texas spent only $66 million in state grant aid, the lowest among the six most populous states despite having the second largest population of postsecondary students. State grant aid began to increase significantly with the establishment of the Toward EXcellence Access, and Success (TEXAS) Grant Program in 1999. In AY 2017–2018, Texas spent about $521 million on grant aid for postsecondary students, less than a quarter of what was spent by California and about three-quarters of what was spent by New York.

State grant aid may be based on financial need, academic merit, a combination of need and merit, or other factors, like veteran status. In Texas, all grant aid is either primarily need-based or has a need-based component. This includes aid that is funded not from legislative appropriations but from institutional revenues, such as the Texas Public Educational Grant (TPEG). This type of aid is often viewed as a form of “tuition discounting”, in which higher prices paid by more affluent students allow students with more financial need to pay less. TPEG, Student Deposit Scholarships, and other such tuition set-aside programs are not included in the state grant aid totals shown above. Tuition exemptions and waivers are also not included in the totals above as they are not considered state grant aid.

Although primarily need-based, maintaining the TEXAS Grant also involves academic requirements. To remain eligible for the grant, the student must maintain a grade point average (GPA) of at least 2.5 on a 4.0 scale, meet Satisfactory Academic Progress (SAP) requirements, and complete at least 24 credit hours per award year.

As funds are generally inadequate to award full grants to all eligible students, initial year TEXAS Grants are awarded on a priority basis. Eligible students receive priority consideration if they meet a priority filing deadline and at least two of four conditions related to high school academic performance (such as having graduated in the top one-third of their high school graduating class or completing at least one math course beyond Algebra II).

Sources: TEXAS Grant Eligibility: College For All Texans, http://www.collegeforalltexans.com/apps/financialaid/tofa2.cfm?ID=458; All other: National Association of State Student Grant and Aid Programs. 49th Annual Survey Report on State-Sponsored Student Financial Aid. 2018 (https://www.nassgapsurvey.com/).

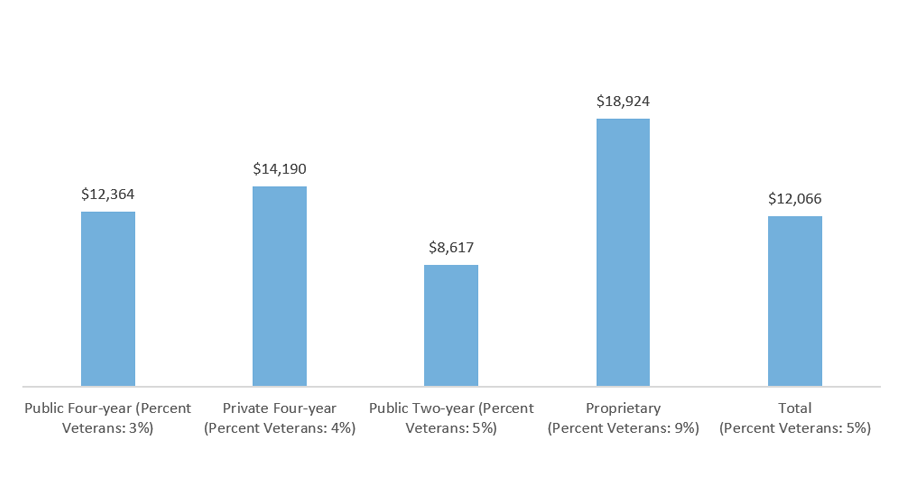

Median Total U.S. Veterans’ Education Benefits in AY 2015-2016

Veterans comprised about 5 percent of all enrolled undergraduates nationwide in academic year 2015-2016 and received a median of $12,066 per person in total federal, state, and institutional veterans’ education benefits* in that year.

The proprietary sector had the highest proportion of veteran undergraduate students, at nine percent, and the highest median amount of benefits received, at $18,924. The median individual amount of total veterans’ education benefits received was lowest at public two-year institutions, at $8,617.

*Institutional benefits include the institutional portion of the Yellow Ribbon program benefits. Federal benefits include Department of Defense military tuition grants and include payments made for tuition and fees, housing, books and supplies, work-study, and other educational expenses (as reported by the Veterans Benefits Administration).

Sources: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

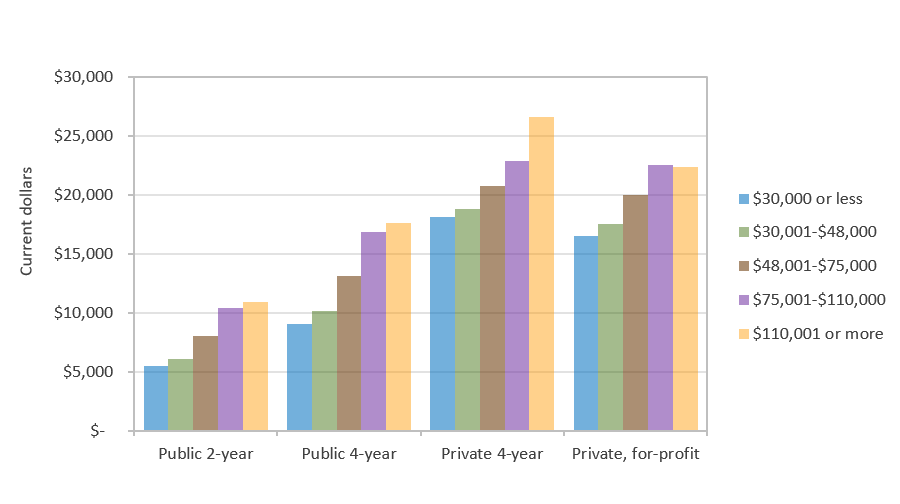

Average Net Price for Full-time, First-time Undergraduates in Texas by Sector and Income Quintile

(AY 2017-2018)

The net price of attendance for a student at an institution of higher education is defined as the student’s cost of attendance* minus the total grants and scholarships he or she receives from any sources: in essence, the amount that a student (and/or family) must pay either out of pocket or with student loans. In Award Year (AY) 2017–2018, the average net price of attendance for students with the lowest incomes** was $5,478 (a decrease of six percent from the previous year) in the public two-year sector, $9,072 (a decrease of one percent) in the public four-year sector, $18,165 (an increase of five percent) in the private four-year sector, and $16,548 (a decrease of 1 percent) in the for-profit sector.

Net price generally rises with income across all four sectors, which likely reflects higher-income students’ tendencies to attend higher-cost institutions and pay a larger percentage of their costs out of pocket. Both of these tendencies are likely more notable in the private four-year sector due to the wider variety of prices in that sector.

* Tuition and fees, books and supplies, food and housing, transportation, and other expenses, for a full-time student for nine months. For public institutions, the net price reflects costs for in-state/in-district students.

** For dependent students, income represents the student’s family income; for independent students, it represents personal income.