State of Student Aid in Texas – 2022

Section 10: Evidence-Based Programs and Interventions

- Interventions to Provide Support and Skills Training Improves

- Employment Outcomes for Students in Some Two-Year Programs

- Individualized Coaching is Effective for Increasing Attainment and Persistence

- Text Nudges Provide Needed “Summer Melt” Intervention at a Low Cost

- Text Nudges Can be Used to Improve Two-Year Outcomes During a Student’s Academic Career

- Need-Based Grants Increase Retention, Graduation, and Enrollment

- Evaluations of Community College Program for Low-Income Students Find Positive Results

- Financial Literacy Can Predict Positive Future Financial Outcomes

Interventions to Provide Support and Skills Training Improves Employment Outcomes for Students in Some Two-Year Programs

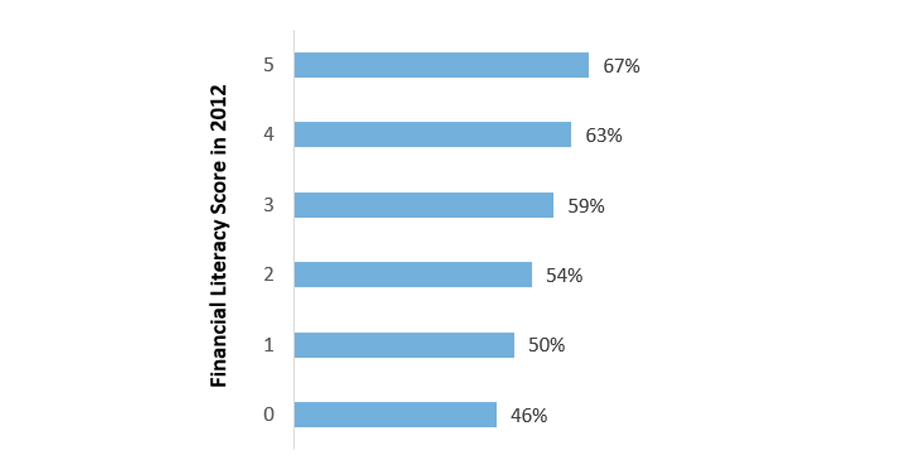

Average Annual Earnings for Project QUEST and Non-Participants

Sources: Project QUEST, Nine Year Gains: Project QUEST’s Continuing Impact, April 2019 (https://questsa.org/quest_impact/).

Individualized Coaching Is Effective for Increasing Attainment and Persistence

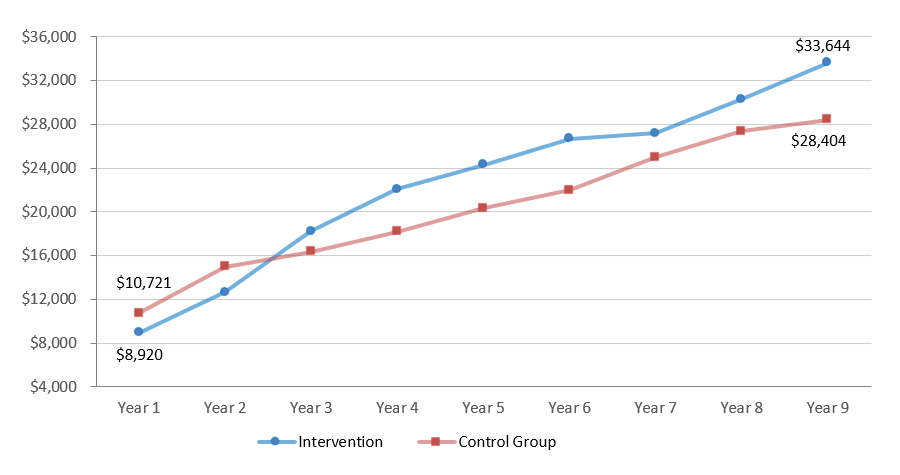

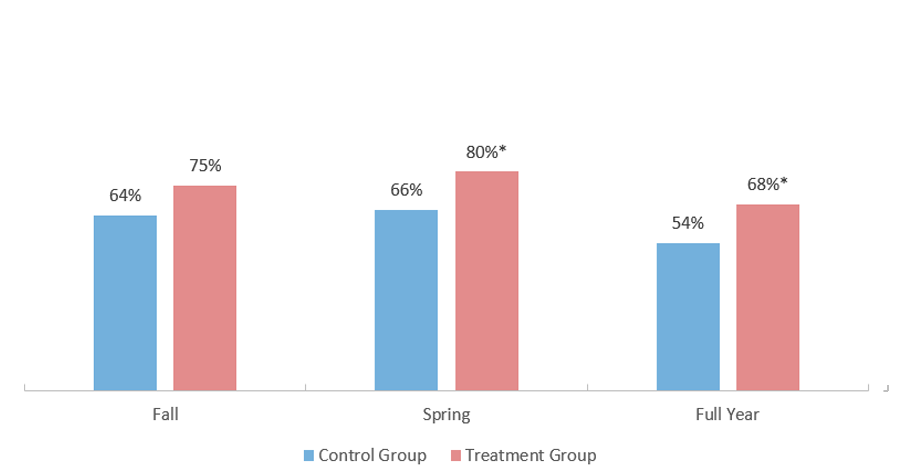

InsideTrack Student Coaching Evaluation: Persistence Increases Associated with Individualized Coaching, Compared to Control Group

Sources: Bettinger and Baker, The Effects of Student Coaching: An Evaluation of a Randomized Experiment in Student Advising, March 2014 (http://journals.sagepub.com/doi/abs/10.3102/0162373713500523).

Text Nudges Provide Needed “Summer Melt” Intervention at a Low Cost

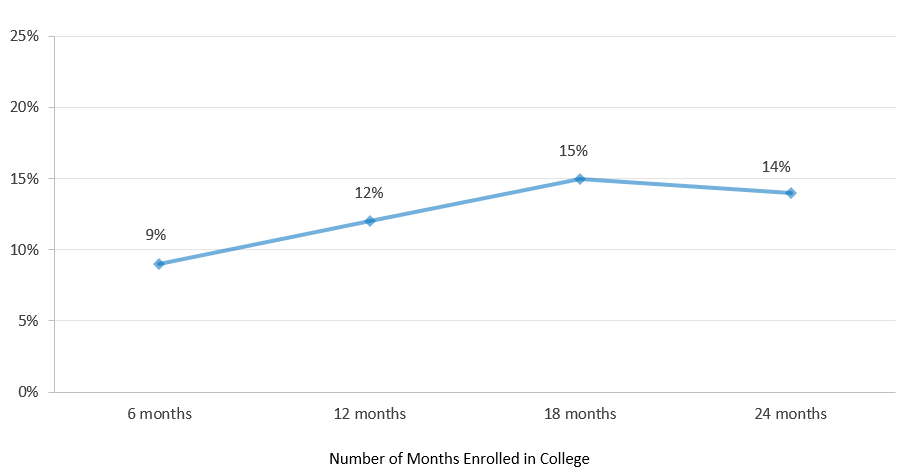

Enrollment Gains from Summer Melt Text Nudges

* Statistically significant at the 0.05 level (p<0.05).

** Summer melt is a term used to describe the occurrence of students indicating their intent to attend a college in the fall but then ultimately not matriculating. Some have defined this term as only including those who did not matriculate at any college while others have defined it as specific to an institution. Students may indicate their intent to attend college through various activities such as expressly saying so on a form to a counselor, paying college deposits, and registering for classes. The activities used to determine intent depend upon the definition being used for summer melt. For the purposes of this study, the researchers used information on students’ expressly stated intentions to attend college and defined summer melt as “the phenomenon that college-intending high school graduates fail to matriculate in college anywhere in the year following high school.”

Sources: Summer Nudging: Can personalized text messages and peer mentor outreach increase college going among low-income high school graduates? Castleman, B. and Page, L., Journal of Economic Behavior and Organization (2015), (https://www.sciencedirect.com/science/article/pii/S0167268114003217).

Text Nudges Can be Used to Improve Two-Year Outcomes During a Student’s Academic Career

Enrollment Change For Two-Year College Students Receiving FAFSA Re-Filing Text Nudges

* Statistically significant at the 0.05 level (p<0.05).

Sources: Freshman year financial nudges: An experiment to increase FAFSA renewal and college persistence. Castleman, B. and Page, L., Journal of Human Resources (2016), (http://jhr.uwpress.org/content/51/2/389.short).

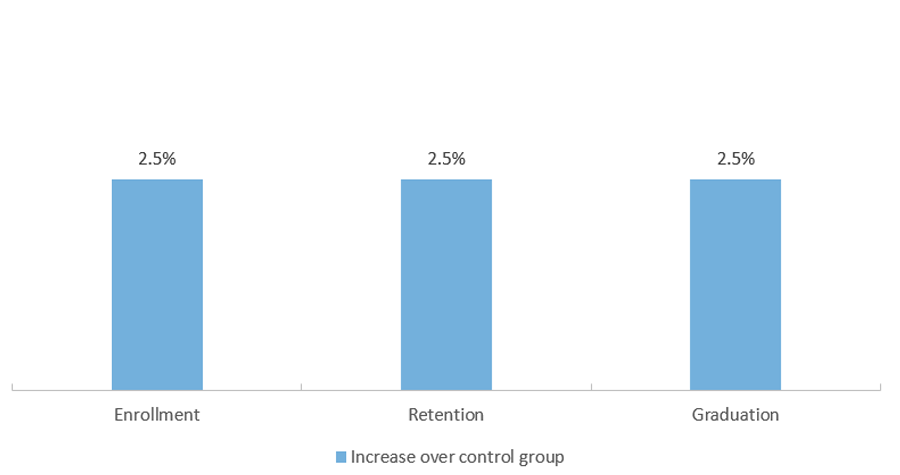

Need-Based Grants Increase Retention, Graduation, and Enrollment

Enrollment, Retention and Graduation Change For College Students Receiving Need-Based Grants

Sources: Eline Sneyers & Kristof De Witte (2018). Interventions in higher education and their effect on student success: a meta-analysis, Educational Review, 70:2, 208-228, DOI: 10.1080/00131911.2017.1300874 (https://doi.org/10.1080/00131911.2017.1300874).

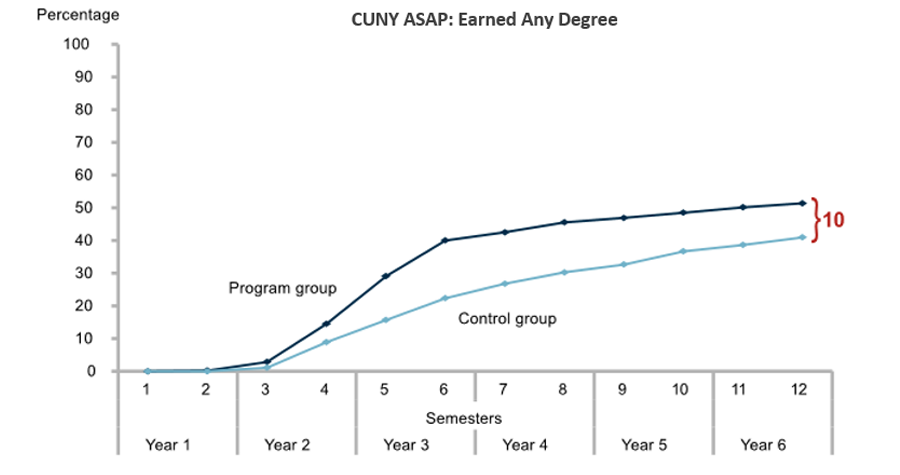

Evaluations of Community College Program for Low-Income Students Find Positive Results

CUNY ASAP: Earned Any Degree

Sources: MDRC, The Power of Fully Supporting Community College Students: The Effects of the City University of New York’s Accelerated Study in Associate Programs After Six Years, October 2017 (https://www.mdrc.org/publication/power-fully-supporting-community-college-students); MDRC, Doubling Graduation Rates in a New State: Two-Year Findings from the ASAP Ohio Demonstration, December 2018 (https://www.mdrc.org/sites/default/files/ASAP_brief_2018_Final.pdf); MDRC, Increasing Community College Graduation Rates with a Proven Model: Three-Year Results from the Accelerated Study in Associate Programs (ASAP) Ohio Demonstration (https://www.mdrc.org/sites/default/files/ASAP_OH_3yr_Impact_Report_1.pdf); ASAP National Replication Collaborative (https://www1.cuny.edu/sites/asap/replication/#1605743953673-ac7ec7cc-d7a9).

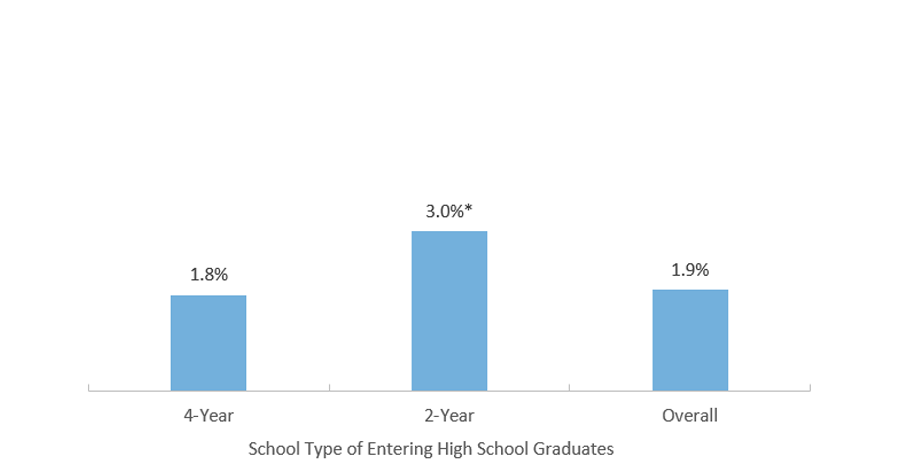

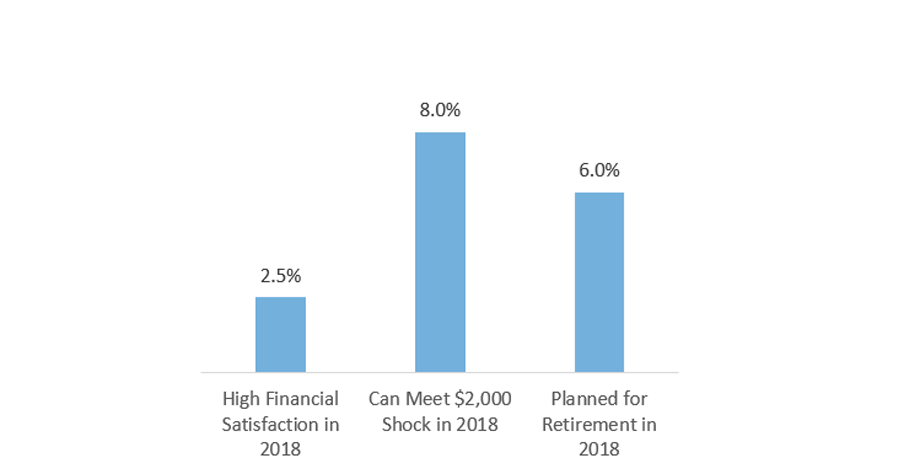

Financial Literacy Can Predict Positive Future Financial Outcomes

Downstream Positive Effects of Increases in Financial Literacy: Percent Increase in 2018 Financial Behavior Relative to the Mean for Every One-Unit Increase in 2012 Financial Literacy Score

Percent Increase in 2018 Ability to Meet $2,000 Shock Relative to the Mean for Every One-Unit Increase in 2012 Financial Literacy Score