State of Student Aid in Texas – 2022

Section 5: Grant Aid and Net Price in Texas

- The Federal Pell Grant is the Largest Source of Grant Aid in Texas

- Institutional Grants Have Highest Average Award

- Grant Recipients in Texas Are Racially/Ethnically Diverse

- The Federal Pell Grant Covers Less Than One-Fifth of Average Public Four-Year Costs

- California, New York, and Florida Top Texas in State Grants

- U.S. Undergraduate Veterans Received About $12,000 in Median Total Veteran’s Education Benefits

- Net Price of Attendance for Lowest-Income Public Four-Year Undergraduates in Texas Is More Than $8,000

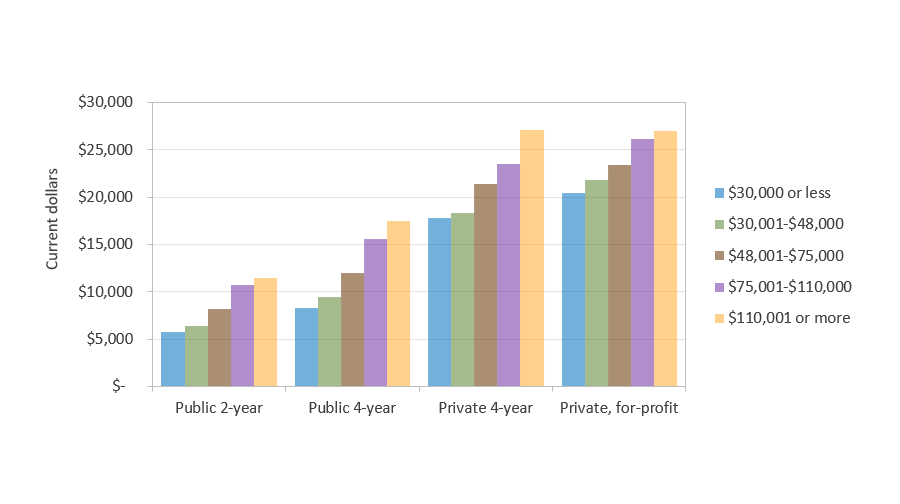

The Federal Pell Grant is the Largest Source of Grant Aid in Texas

Total Grant Aid Awarded in Texas by Major Grant Program, FY2019-2020*

* Amounts for state aid programs are reported by fiscal year, whereas Pell and SEOG are reported by award year (see Glossary)

Sources: Aid in Texas: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2020 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2020/).

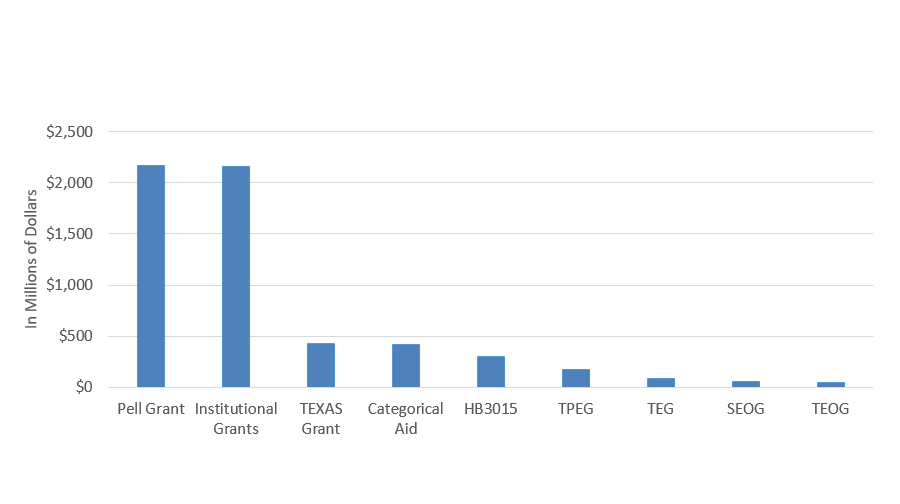

Institutional Grants Have Highest Average Award

Average Grant Award in Texas by Major Grant Program, FY2019-2020

Sources: Aid in Texas: Texas Higher Education Coordinating Board, Report on Student Financial Aid in Texas Higher Education, Fiscal Year 2020 (http://reportcenter.thecb.state.tx.us/reports/data/report-on-student-financial-aid-in-texas-higher-education-for-fy-2020/); Maximum Pell: U.S. Department of Education, Federal Student Aid (https://studentaid.ed.gov/sa/types/grants-scholarships/pell).

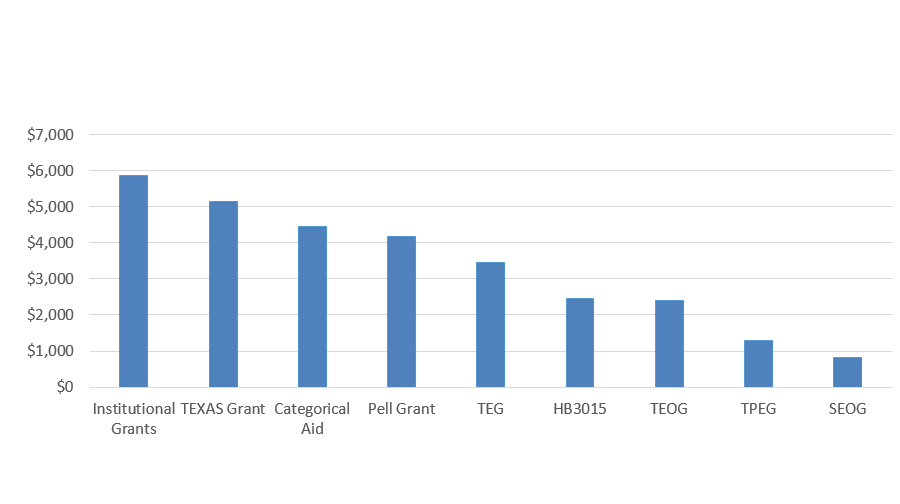

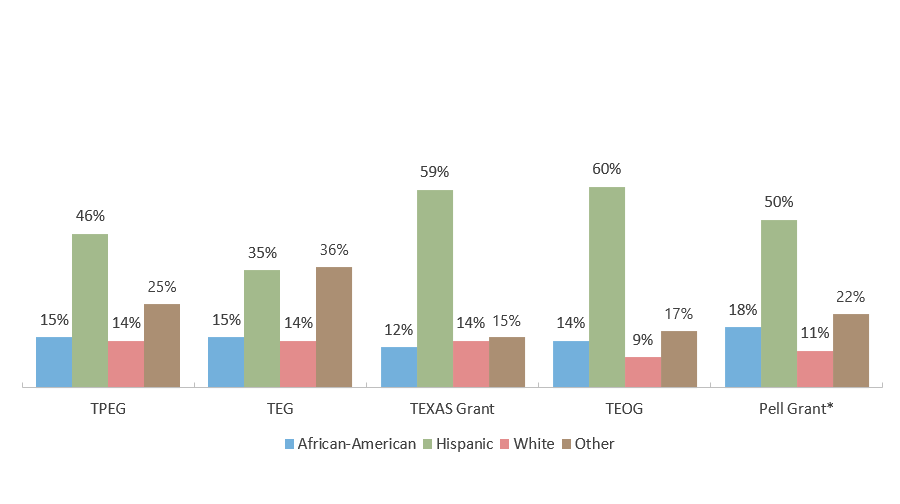

Grant Recipients in Texas Are Racially/Ethnically Diverse

Fall 2019 Enrollment in Texas Higher Education, by Ethnicity

Fiscal Year 2019-2020 Grant Program Recipients by Ethnicity

* Pell grant data did not disaggregate “Asian/Pacific Islander” from “Other”, so both are included in “Other”.

Sources: Enrollment by ethnicity: U.S. Dept of Education, National Center for Education Statistics, IPEDS (https://nces.ed.gov/ipeds/); Texas grant programs: THECB Financial Aid Database for Fiscal Year 2020 (special request, unpublished tables).

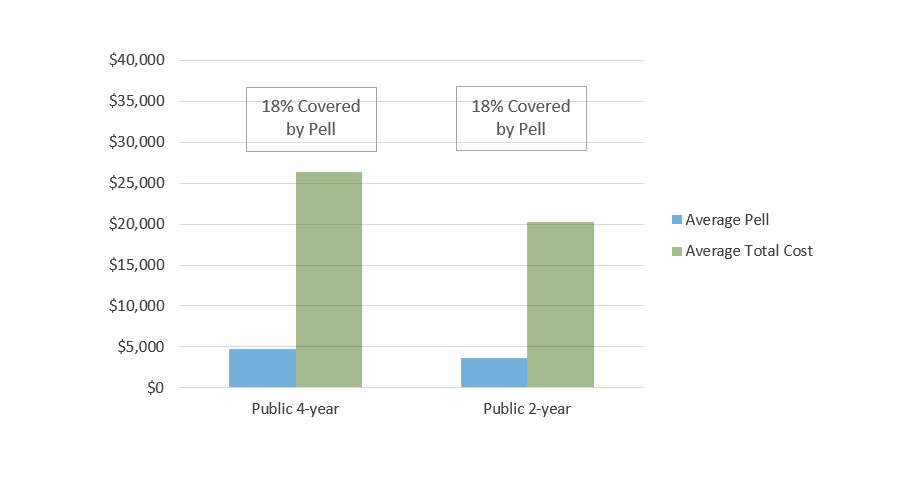

The Federal Pell Grant Covers Less Than One-Fifth of Average Public Four-Year Costs

Total Cost of Attendance for Two Semesters Full-time Attendance at Texas Public Institutions Covered by Average Pell Grant Amount, by Sector (AY 2020-2021)

Sources: Cost of attendance: U.S. Department of Education, National Center for Education Statistics, IPEDS Data Center (Author’s calculation: Total cost of full-time undergraduate attendance weighted by FTE in-state undergraduate enrollment) (http://nces.ed.gov/ipeds/datacenter/); Pell: U.S. Department of Education, Federal Student Aid Data Center, Programmatic Volume Reports (http://studentaid.ed.gov/about/data-center/student/title-iv); Maximum Pell: U.S. Department of Education, Federal Student Aid (https://studentaid.ed.gov/sa/types/grants-scholarships/pell).

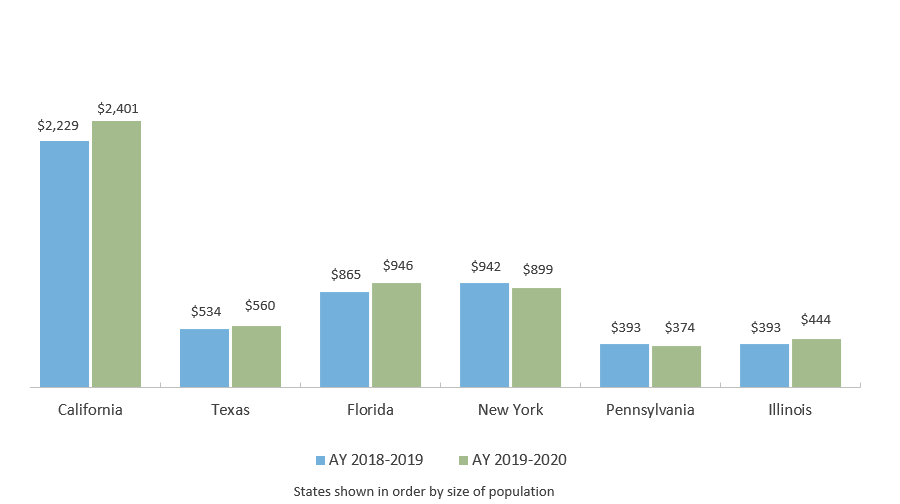

California, New York, and Florida Top Texas in State Grants

Total State Grant Aid (millions of current dollars)

Sources: TEXAS Grant Eligibility: College For All Texans, http://www.collegeforalltexans.com/apps/financialaid/tofa2.cfm?ID=458; All other: National Association of State Student Grant and Aid Programs. 51st Annual Survey Report on State-Sponsored Student Financial Aid. 2020 (https://www.nassgapsurvey.com/); National Association of State Student Grant and Aid Programs. 50th Annual Survey Report on State-Sponsored Student Financial Aid. 2019 (https://www.nassgapsurvey.com/).

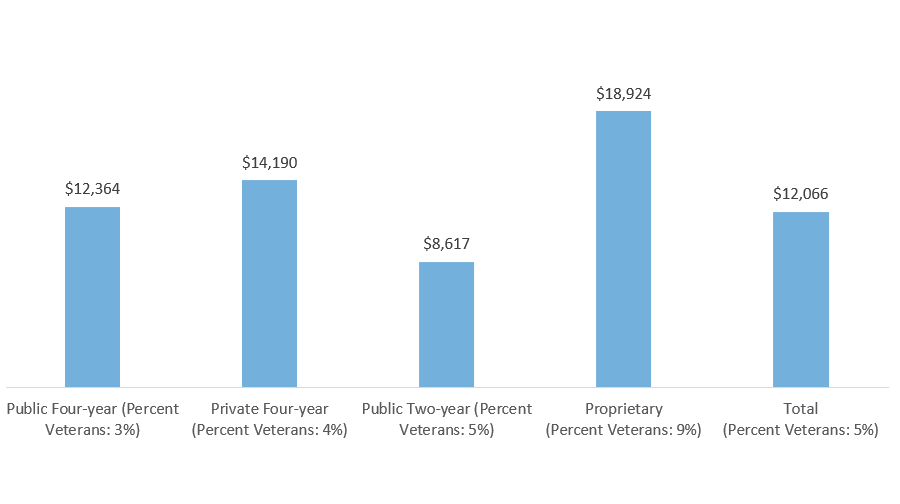

U.S. Undergraduate Veterans Received About $12,000 in Median Total Veterans’ Education Benefits

Median Total U.S. Veterans’ Education Benefits in AY 2015-2016

* Institutional benefits include the institutional portion of the Yellow Ribbon program benefits. Federal benefits include Department of Defense military tuition grants and include payments made for tuition and fees, housing, books and supplies, work-study, and other educational expenses (as reported by the Veterans Benefits Administration).

Sources: U.S. Department of Education, National Postsecondary Student Aid Study (NPSAS) 2016 (http://www.nces.ed.gov/das).

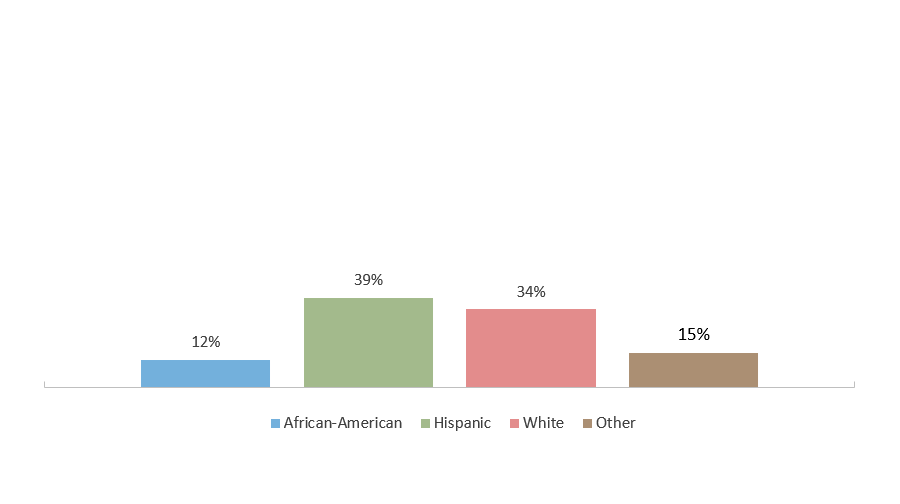

Net Price of Attendance for Lowest-Income Public Four-Year Undergraduates in Texas Is More Than $8,000

Average Net Price for Full-time, First-time Undergraduates in Texas by Sector and Income Quintile (AY 2019-2020)