State of Student Aid in Texas – 2020

Section 9: Student Financial Wellness

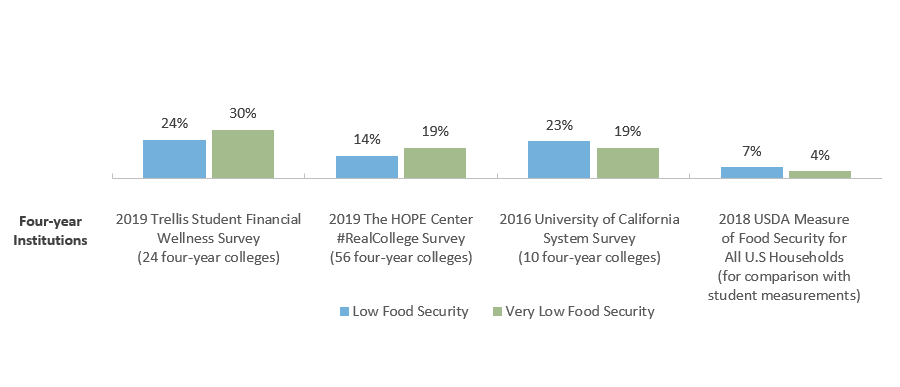

Recent Studies of Food Security Amongst College Students Using the U.S. Department of Agriculture Scale, Four-year Institutions

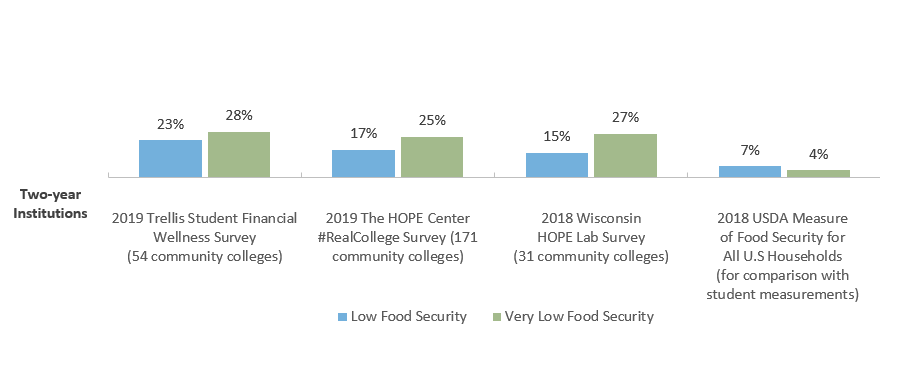

Recent Studies of Food Security Amongst College Students Using the U.S. Department of Agriculture Scale, Two-year Institutions

A growing body of research has explored the degree to which postsecondary students are struggling to meet their basic needs, such as housing and food. While more research is needed to explore the extent to which basic needs insecurity affects student success, it is reasonable to assume that students who struggle with hunger, nutrition, and/or finding safe shelter will have a more difficult path to earning a degree. The measurement tool designed by the United States Department of Agriculture (USDA) defines low food security as “reports of reduced quality, variety, or desirability of diet” and very low food security as “reports of multiple indications of disrupted eating patterns and reduced food intake.” While no nationally representative research is available for food insecurity among college students, a number of studies have found similar, troubling levels.

In the Fall 2019 Student Financial Wellness Survey (SFWS) from Trellis Company, researchers found that 54 percent of students at four-year colleges and 51 percent of students at community colleges experience low or very low food security. The survey was open to any college nationwide that wanted to participate, and of the 78 colleges (in 20 states) in the study, 54 were community colleges and 24 were four-year institutions. Greater food insecurity amongst the four-year institution cohort in the Trellis study compared to other studies may be explained by the participating institutions that tended to serve under-resourced students at higher rates than average four-year institutions.

Note: The Trellis survey used the condensed 6-question food security scale while the other surveys used the 10-question version.

Sources: United States Department of Agriculture (USDA). 2017. Definitions of food security. https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/definitions-of-food-security/; Klepfer, K. Cornett, A. Fletcher, C. & Webster, J. Student Financial Wellness Survey: Fall 2019 (unpublished tables); Baker-Smith, C. Coca, V. Goldrick-Rab, S. Looker, E. Richardson, B. & Williams, T. (2020). #RealCollege 2020: Five Years of Evidence on Campus Basic Needs Insecurity. The HOPE Center for College, Community, and Justice. https://hope4college.com/wp-content/uploads/2020/02/2019_RealCollege_Survey_Report.pdf; Baker

Goldrick-Rab, S., Richardson, J., Schneider, J., Hernandez, A., & Cady, C. (2018). Still Hungry and Homeless in College. Wisconsin HOPE Lab. https://hope4college.com/wp-content/uploads/2018/09/Wisconsin-HOPE-Lab-Still-Hungry-and-Homeless.pdf; Martinez, S., Maynard, K., & Ritchie, L. (2016). Student food access and security study. University of California Global Food Initiative. http://regents.universityofcalifornia.edu/regmeet/july16/e1attach.pdf; Coleman-Jensen, Alisha, Matthew P. Rabbitt, Christian A. Gregory, and Anita Singh. 2019. Household Food Security in the United States in 2018, ERR-270, U.S. Department of Agriculture, Economic Research Service. https://www.ers.usda.gov/webdocs/publications/94849/err-270.pdf?v=963.1

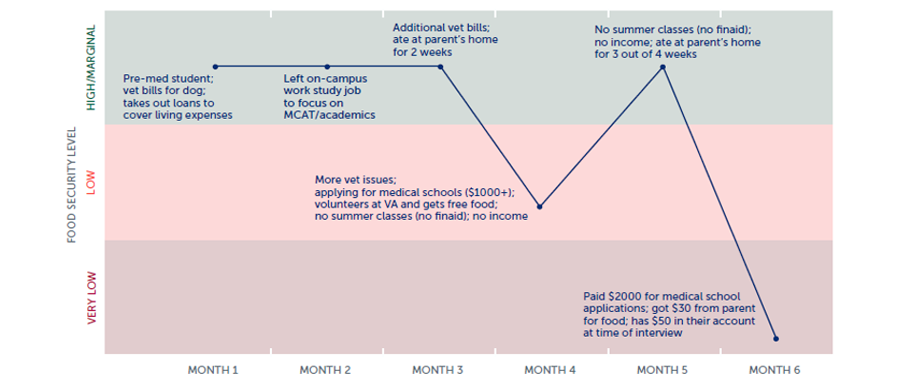

While quantitative surveys differentiate magnitudes of food security and report prevalence at a specific point in time – key metrics for understanding and managing aspects related to student success – they give us little insight into these students’ day-to-day lives. To address this gap, Trellis Company conducted a qualitative study that interviewed 72 students once a month for nine months to better understand the dynamics behind student finances and academic performance. The first report from this effort, Studying on Empty: A Qualitative Study of Low Food Security among College Students, examines the lived experiences of 36 students who indicated they experienced low (LFS) or very low food security (VLFS) at least once during the nine-month study. This longitudinal perspective revealed a more fluid, fluctuating pattern of collegiate food security than is commonly understood, where sudden changes in financial stability (e.g., shifts in employment, financial aid, social networks, medical issues, personal budgeting, etc.) degraded or improved a student’s food security.

Over the course of the study, 26 participants experienced a decline in food security from one interview to the next.* Catalysts for degraded food security often included loss of employment, housing disruptions, and loss of financial aid.

In the case above, a combination of ambitious academic and career goals, costly medical school applications, and recurring veterinary expenses resulted in the student’s level of food security dropping twice. The student was food secure for the first three months of the study and had a restrictive, but attainable, budget. This changed in month four, where food security dropped from high/marginal to low due to a combination of: (1) recurring vet expenses; (2) pricey medical school applications; and (3) leaving her part-time, on-campus job to focus on academics. Fortunately, the student was able to secure free food through volunteering efforts and at her parents’ home. This temporarily increased her food security for one month, but without financial aid or other regular sources of income, her financial and food situation degraded further to very low. By month six, she completely drained her savings after paying over $2,000 in medical school applications; and although she had received $30 from a parent for food, she only had $50 in her bank account at the time of the last interview.

*Researchers are unable to rule out the possibility that declining food security may be explained, in part, by the subjects becoming more comfortable discussing this sensitive topic with interviewers.

Sources: Cornett, A., & Webster, J. (2020). Longitudinal Fluidity in Collegiate Food Security: Disruptions, Restoration, and Its Drivers. Trellis Company. Retrieved from: https://www.trelliscompany.org/wp-content/uploads/2020/02/Research-Brief_FSS_Longitudinal-Fluidity.pdf; Fernandez, C., Webster, J., & Cornett, A. (2019). Studying on Empty: A Qualitative Study of Low Food Security among College Students. Trellis Company. Retrieved from: https://www.trelliscompany.org/wp-content/uploads/2019/09/Studying-on-Empty.pdf

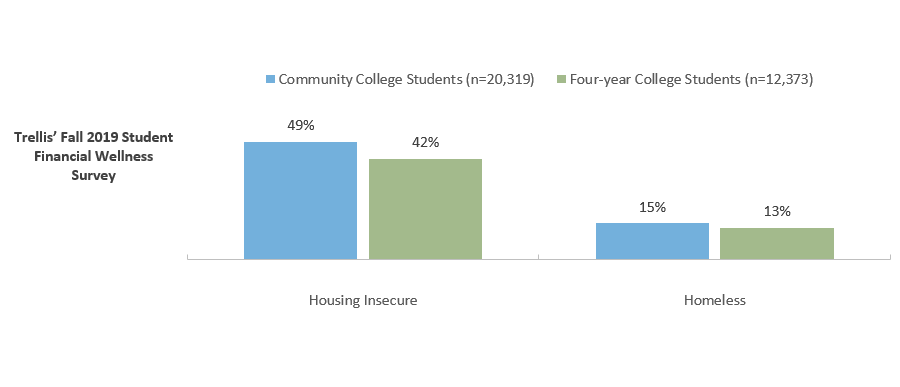

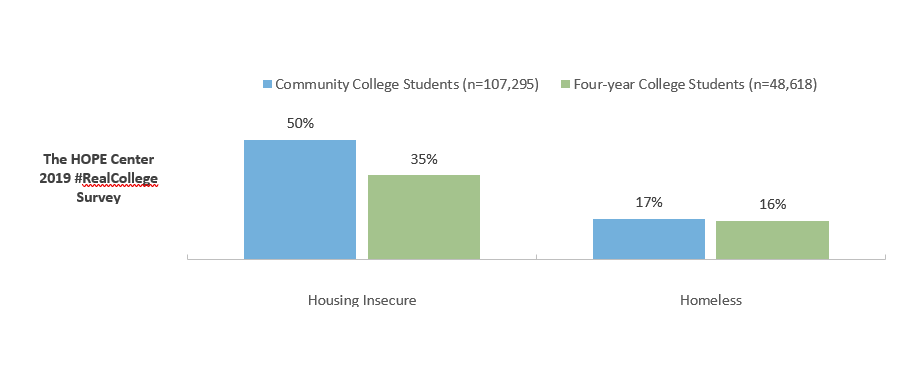

Housing Security and/or Homelessness within Prior Twelve Months at Community and Four-year Colleges

Housing Security and/or Homelessness within Prior Twelve Months at Community and Four-year Colleges

Recent studies by Trellis and the HOPE Center for College, Community, and Justice have found similar, high levels of housing insecurity and homelessness among college students. Being homeless or “without a place to live, often residing in a shelter, an automobile, an abandoned building, or outside” can make an already challenging college experience even more difficult. Housing insecurity, including inability to pay full housing costs and moving in with others due to financial issues, is less severe, but can also make the college experience difficult. As the cost of college rises, basic needs security may become a barrier to success for more students. Some colleges are addressing housing issues with emergency grants, temporary housing, and partnerships with local organizations to provide rental assistance to students.

Trellis’ Fall 2019 Student Financial Wellness Survey found 49 percent of community college students and 42 percent of four-year college students experienced housing insecurity in the previous 12 months. The Trellis study found that 15 percent of community college students and 13 percent of four-year students experienced homelessness in that same time period. The survey was open to any college nationwide that wanted to participate, and of the 78 colleges (in 20 states) in the study, 54 were community colleges and 24 were four-year institutions. The 2019 study by the HOPE Center for College, Community, and Justice found similar results as Trellis’ Student Financial Wellness Survey.

Sources: Klepfer, K. Cornett, A. Fletcher, C. & Webster, J. Student Financial Wellness Survey: Fall 2019 (unpublished tables); Baker-Smith, C. Coca, V. Goldrick-Rab, S. Looker, E. Richardson, B. & Williams, T. (2020). #RealCollege 2020: Five Years of Evidence on Campus Basic Needs Insecurity. The HOPE Center for College, Community, and Justice. https://hope4college.com/wp-content/uploads/2020/02/2019_RealCollege_Survey_Report.pdf. U.S. News and World Report (February 27, 2018). A New Focus on College Campuses: Ending Housing Insecurity. https://www.usnews.com/news/education-news/articles/2018-02-27/campus-focus-on-solving-housing-insecurity-helping-homeless-students.

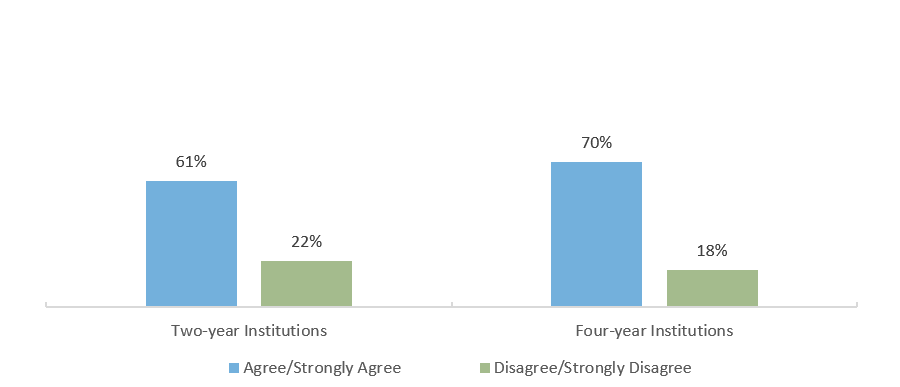

Q51: I worry about having enough money to pay for school.*

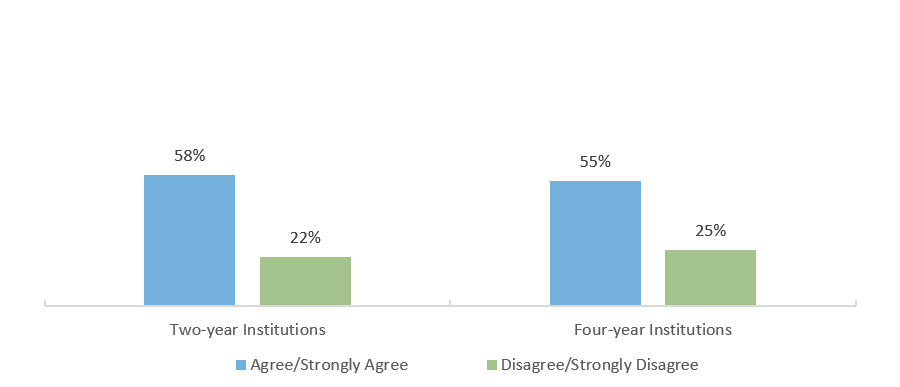

Q52: I know how I will pay for college next semester.*

There is growing recognition that the interplay of student collegiate finances and academic performance influences key student outcomes like retention and graduation. It is common practice for a student to develop an academic plan for college, but often there is no accompanying financial plan to help the student plan for the high direct and indirect costs of college. With these costs, those students with financial challenges may find themselves unsure of whether they can or should re-enroll in their next semester.

In Trellis’ Fall 2019 Student Financial Wellness Survey, many students surveyed signaled concerns about being able to afford college. More than three in five respondents (61 percent) at two-year institutions and 70 percent of respondents at four-year institutions either agreed or strongly agreed that they worry about having enough money to pay for school. Twenty-two percent of respondents at two-year institutions and 25 percent of respondents at four-year institutions either disagreed or strongly disagreed that they knew how they would pay for college next semester.

Note: Trellis’s Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2019 implementation, 78 colleges in 20 states participated – 54 community colleges and 24 four-year institutions. There were 23,684 respondents attending public two-year institutions and 14,804 respondents attending four-year institutions. The results are not nationally representative.

*Responses indicating ‘Neutral’ are not shown

Sources: Klepfer, K. Cornett, A. Fletcher, C. & Webster, J. Student Financial Wellness Survey: Fall 2019 (unpublished tables).

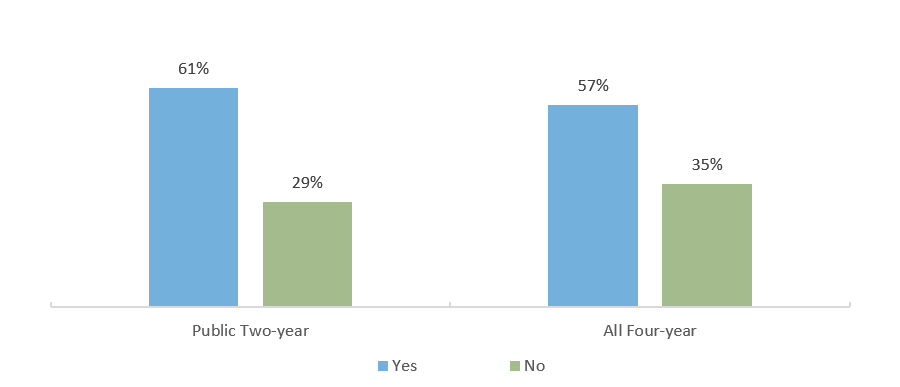

Q44: Would you have trouble getting $500 in cash or credit in order to meet an unexpected need within the next month?*

For students on tight budgets, persisting in school often depends on financial plans that go smoothly, as even modest disruptions due to accidents, illness, or unanticipated expenses can impede success. Cash-strapped students face these contingencies with fewer options than their more affluent peers, often engaging in extreme frugality and untenable work schedules that threaten their health and diminish their learning experiences. For students who are financially vulnerable, a relatively small expense can force difficult decisions around staying enrolled in college.

In the Fall 2019 Trellis Student Financial Wellness Survey, more than three in five respondents (61 percent) from two-year institutions and 57 percent of respondents at four-year institutions indicated they would have trouble getting $500 in cash or credit in an emergency. Given students’ financial vulnerability and lower confidence in paying for college, student success initiatives could benefit from financial components such as emergency aid programs that provide small dollar grants to students in financial emergencies. These types of interventions have improved student retention.

Note: Trellis’s Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2019 implementation, 78 colleges in 20 states participated – 54 community colleges and 24 four-year institutions. There were 23,684 respondents attending public two-year institutions and 14,804 respondents attending four-year institutions. The results are not nationally representative.

Sources: Klepfer, K. Cornett, A. Fletcher, C. & Webster, J. Student Financial Wellness Survey: Fall 2019 (unpublished tables); Kruger, K., Parnell, A., & Wesaw, A. 2016. “Landscape analysis of emergency aid programs.” National Association of Student Personnel Administrators (NASPA). https://www.naspa.org/images/uploads/main/Emergency_Aid_Report.pdf.

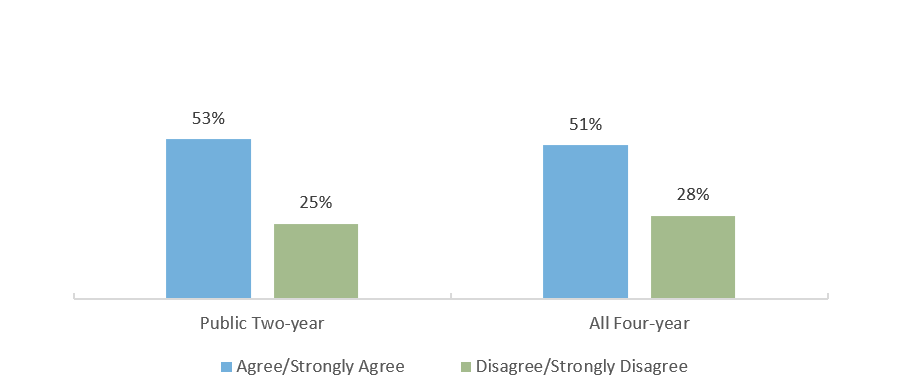

Q50: I worry about being able to pay my current monthly expenses.*

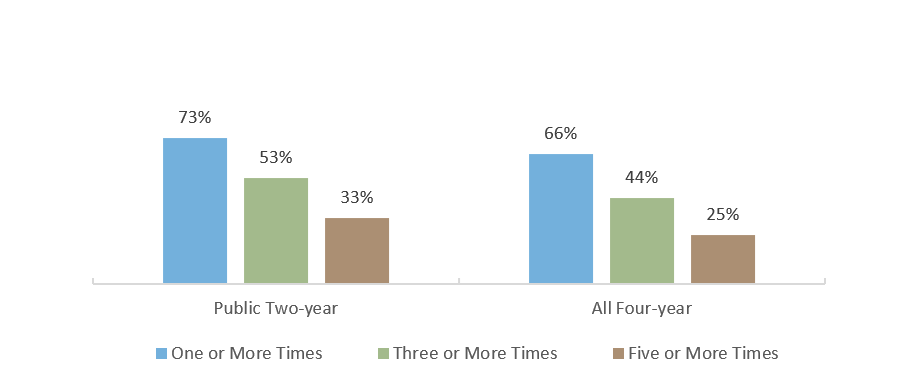

Q45: In the past 12 months, how many times did you run out of money?

Some of the anxiety around paying for school may be driven by students’ concern for their day-to-day expenses. In the Fall 2019 Trellis Student Financial Wellness Survey, more than half of respondents – 53 percent at two-year institutions and 51 percent at four-year institutions – worried to some degree about paying for their current monthly expenses.

It takes careful planning for students to meet their expenses and manage a limited, often uncertain, cash flow while attending school. Nearly three-quarters of respondents (73 percent) at two-year institutions – and a third of respondents at four-year institutions – reported running out of money at least once in the past 12 months. Alarmingly, a third of respondents at two-year institutions and a quarter of respondents at four-year institutions reported running out of money at least five times in the past 12 months.

Note: Trellis’s Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2019 implementation, 78 colleges in 20 states participated – 54 community colleges and 24 four-year institutions. There were 23,684 respondents attending public two-year institutions and 14,804 respondents attending four-year institutions. The results are not nationally representative.

*Responses indicating ‘Neutral’ are not shown

Sources: Klepfer, K. Cornett, A. Fletcher, C. & Webster, J. Student Financial Wellness Survey: Fall 2019 (unpublished tables).

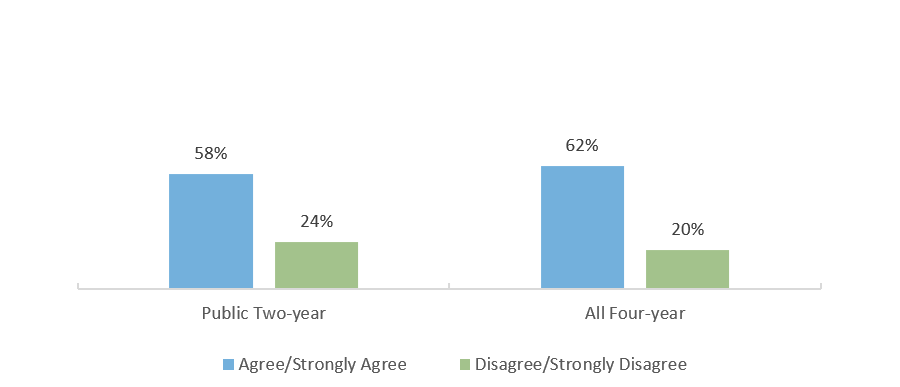

Q69: I have more student loan debt than I expected to have at this point. (of those who indicated having a student loan they took out for themselves)

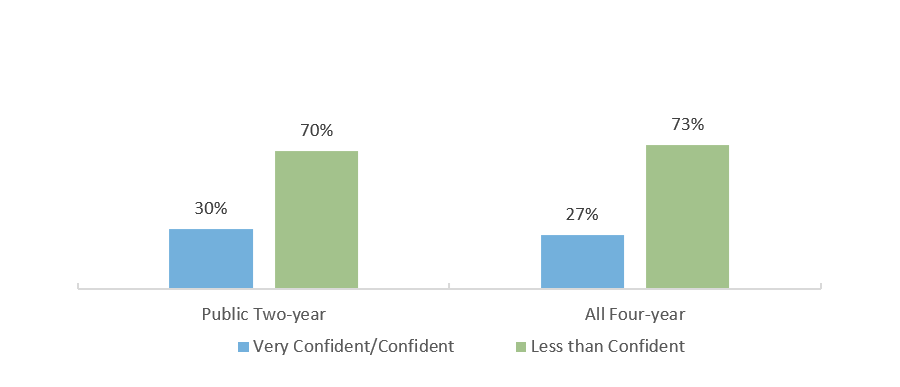

Q70: How confident are you that you will be able to pay off the debt acquired while you were a student? (of those who indicated having a student loan they took out for themselves)*

Paying for college often involves piecing together money from a variety of sources, including federal, state, institutional, and private grants, family support, personal income, savings, and various loan products. Research indicates that half of all students borrow in their first year of college, and half of the remaining students borrow within six years of enrolling.

Estimating college expenses can be difficult, especially for students who are the first in their families to attend college. In the Fall 2019 Trellis Student Financial Wellness Survey, more than half of respondents who borrowed (58 percent) at two-year institutions and 62 percent of respondents at four-year institutions agreed or strongly agreed with the statement that they had more student loan debt than they expected at this point. Many students borrow with no confidence in their ability to repay. More than two-thirds of respondents who borrowed (70 percent) at two-year institutions and 73 percent of respondents at four-year institutions were not at all confident or only somewhat confident they would be able to pay off the debt acquired while they were a student.

Note: Trellis’s Student Financial Wellness Survey is open to any college nationwide that wants to participate. In the fall 2019 implementation, 78 colleges in 20 states participated – 54 community colleges and 24 four-year institutions. There were 23,684 respondents attending public two-year institutions and 14,804 respondents attending four-year institutions. The results are not nationally representative.

*Responses indicating ‘Neutral’ are not shown

Sources: Klepfer, K. Cornett, A. Fletcher, C. & Webster, J. Student Financial Wellness Survey: Fall 2019 (unpublished tables); Gladieux, L., & Perna, L. (2005). “Borrowers Who Drop Out: A Neglected Aspect of the College Student Loan Trend.” The National Center for Public Policy and Higher Education.

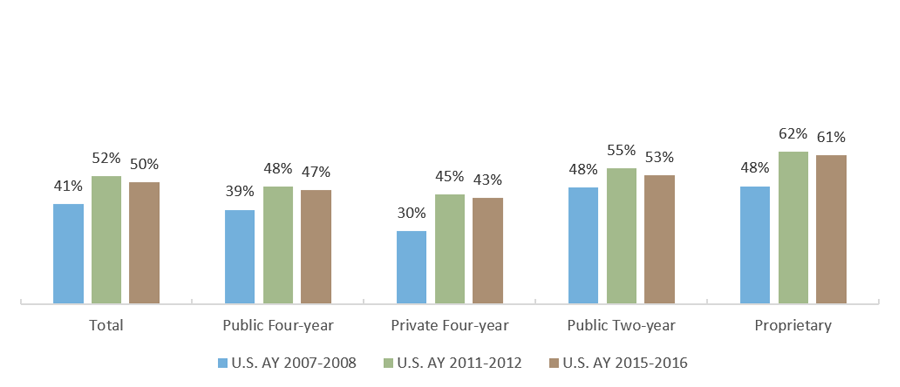

Percentage of Undergraduates Nationally Who Carry a Credit Card Balance by Institution Sector

(AY 2007-2008, AY 2011-2012, AY 2015-2016)

Students at public two-year and at proprietary institutions were more likely to carry a credit card balance, incurring added costs in the form of interest, compared to students attending four-year public or nonprofit institutions. Undergraduates in all sectors were considerably more likely to carry credit card debt in award year (AY) 2011-2012 and AY 2015-2016 than in AY 2007-2008. This increase likely has several causes: more expensive tuition costs, reductions in funding for state and institutional aid programs, and economic factors like low wages. As of AY 2011-2012, 52 percent of undergraduates nationally carried balances on their credit cards.