State of Student Aid in Texas – 2022

Section 13: Texas Higher Education and Student Debt Policy

- Progress on 60x30TX Goals

- Higher Education Highlights from the 87th Legislative Session

- Funding for TEXAS Grant, TEOG, and TEG Increase for the 2022-2023 Biennium

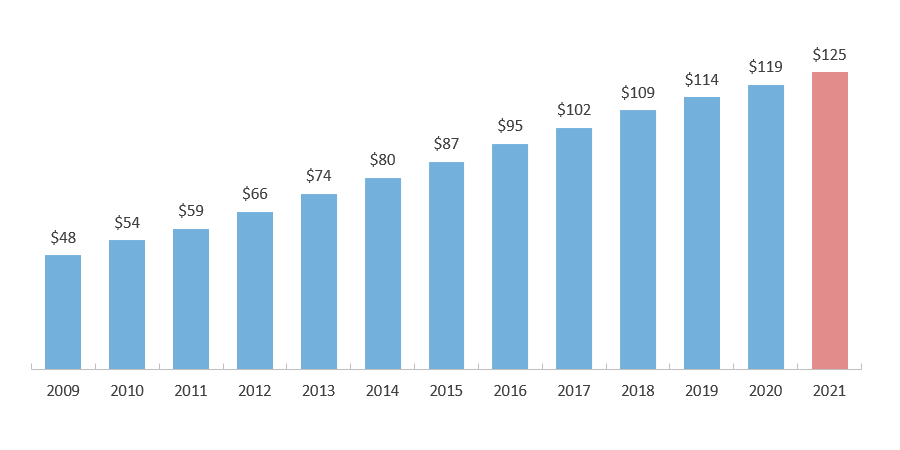

- Student Loan Debt in Texas Grows Faster Than the U.S.; Reaches $125 Billion

- A Majority of Federal Public Service Loan Forgiveness Applications Have Been Processed and Approved

- Legislation Brings Big Changes to FAFSA, Need Analysis, and Access to Federal Aid

- Student Loan Repayment Pause Repeatedly Extended As the COVID-19 Pandemic Continues

- COVID-19 Legislation Aims to Help Higher Education Institutions and Students

- CARES Act Allocations in Texas Regions

- CARES Act Allocations Vary by Sector in Texas

- Consolidated Appropriations Act Allocates Aid to Areas of Greatest Need

- Consolidated Appropriations Act Channels Relief Disproportionately to Public Four-Year Sector

Progress on 60x30TX Goals

60x30TX Goal Updates

| 2015 (Baseline) | 2020 | 2030 Goal | ||

|---|---|---|---|---|

| Overall Attainment Rate | 40.3% | 45.3% | 60% | |

| Completion Goals | Overall Completion Total | 311,340 | 348,394 | 550,000 |

| Hispanic Completion | 96,657 | 125,151 | 285,000 | |

| African American Completion | 38,964 | 41,265 | 76,000 | |

| Male Completion | 131,037 | 143,471 | 275,000 | |

| Economically Disadvantaged Completion | 114,176 | 128,983 | 246,000 | |

| Texas High School Graduates Enrolling in Texas Higher Education | 52.7% | 44.9% | 65% | |

| Marketable Skills Goal | Working or Enrolled Within One Year | 78.9% | 79.0% | 80% |

| Student Debt Goals | Student Loan Debt to First-Year-Wage Percentage | 60% | 51% | 60% |

| Excess SCH Attempted | 19 | 14 | 3 | |

| Percent of Undergraduates Completing with Debt | 49.2% | 44.1% | 50% |

Sources: Texas Higher Education Coordinating Board. THECB 60×30 Progress Report, July 2021 (https://reportcenter.highered.texas.gov/reports/data/60x30tx-progress-report-july-2021/).

Higher Education Highlights from the 87th Legislative Session

SB 1860: Relating to Creating an Electronic Application System for State Student Financial Assistance

- Requires the Texas Higher Education Coordinating Board to develop a process by the 2023-2024 school year that would allow students to complete the Texas Application for State Financial Aid online on the same website as the common admission application form

SB 1888: Relating to the Establishment of Certain Programs to Facilitate Early High School Graduation and Enrollment at Public Institutions of Higher Education

- Establishes the Texas First Early High School Completion Program and the Texas First Scholarship, which allows public high school students who demonstrate early college readiness to graduate early from high school and receive financial aid

- Establishes eligibility requirements for the scholarship program and requires the Texas Higher Education Coordinating Board to establish standards for determining early readiness for college

HB 3767: Relating to Measures to Support Workforce Development in the State, Including the Establishment of the Tri-Agency Workforce Initiative and Additional Employer Workforce Data Reporting

- Requires the Texas Workforce Commission, Texas Education Agency, and the Texas Higher Education Coordinating Board to create interagency agreements to share, match, and manage education and workforce data and coordinate resources

- Requires the three agencies to regularly update a list of career pathways based on current needs and forecasted demands, in consultation with employers

Sources: Texas Higher Education Coordinating Board (THECB), Legislative and Media Resources, Higher Education Policy and Appropriations, “Summary of Higher Education Legislation, 87th Texas Legislature” (2021) (https://reportcenter.highered.texas.gov/training-materials/presentations/summary-of-higher-education-legislation-87r/).

Funding for TEXAS Grant, TEOG, and TEG Increase for the 2022-2023 Biennium

Major Texas Financial Aid Programs, Appropriated Funds by State Program and State Fiscal Year*

| 2020-2021 Biennium | 2022-2023 Biennium | |

|---|---|---|

| Towards EXcellence Access and Success (TEXAS) Grant | $866.4 | $950.1 |

| Texas Educational Opportunity Grant (TEOG) | $96.0 | $105.2 |

| Tuition Equalization Grant (TEG) | $178.6 | $195.8 |

| Graduate Medical Education Expansion | $157.2 | $199.1 |

| Nursing Shortage Reduction Program | $19.9 | $18.9 |

* The Texas state fiscal year is September 1 through August 31.

Sources: Legislative Budget Board, State Budget by Program “87th Regular Session, Final Bill” (http://sbp.lbb.state.tx.us/).

Student Loan Debt in Texas Grows Faster Than the U.S.; Reaches $125 Billion

Estimated Outanding Student Debt in Texas (in billions*)

* Estimates are based on state-level per capita student debt averages from the Federal Reserve Bank of New York Consumer Credit Panel, which excludes persons without credit reports and persons living in counties where fewer than 10,000 people have credit reports. The result for a given year is adjusted by the same factor by which the result of this methodology for the United States as a whole deviates from the United States total outstanding student debt for that year as reported in the Quarterly Report on Household Debt and Credit. This adjustment, which was not made in some previous editions of SOSA, has been applied to all years.

** The FFEL Program ended in 2010, but borrowers are still making payments on outstanding FFEL balances.

Sources: U.S. Student Loan Debt Estimate: Federal Reserve Bank of New York (FRBNY), Quarterly Report on Household Debt and Credit, 2021:Q4 (https://www.newyorkfed.org/microeconomics/hhdc/background.html), Texas Student Loan Debt Estimate: FRBNY, Household Debt and Credit Statistics by State (https://www.newyorkfed.org/microeconomics/databank.html); Non-federal borrowing: College Board. Trends in Student Aid 2021 (https://trends.collegeboard.org/student-aid/figures-tables/total-federal-and-nonfederal-loans-over-time).

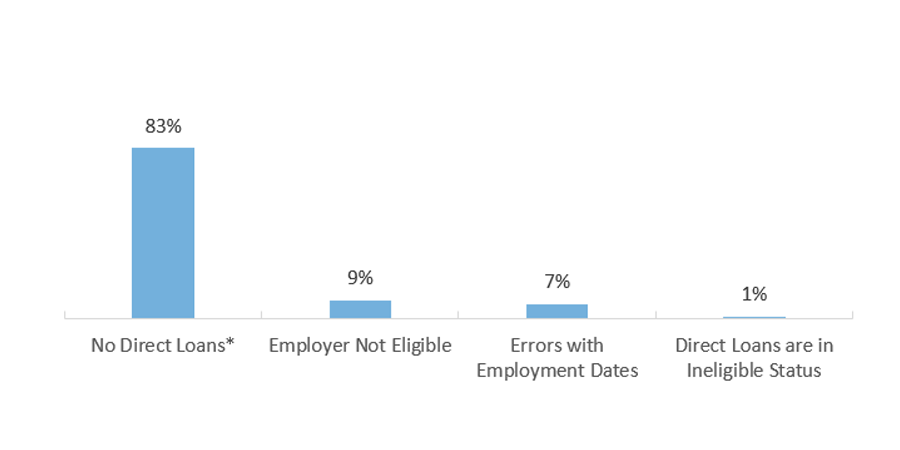

A Majority of Federal Public Service Loan Forgiveness Applications Have Been Processed and Approved

Reasons PSLF Applications Did Not Meet Employment Certification Requirements

* Borrowers were able to submit employment certification data for student loans that were not Direct Loans. The loans would still need to be consolidated into the Direct Loan Program in order to benefit from PSLF. After consolidation, the borrower’s submitted form will be reevaluated to apply any earned PSLF credit.

Sources: U.S. Department of Education, Federal Student Aid, Public Service Loan Forgiveness Data: https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data; U.S. House Committee of Education and the Workforce, PROSPER Act: https://www.congress.gov/bill/115th-congress/house-bill/4508.

Legislation Brings Big Changes to FAFSA, Need Analysis, and Access to Federal Aid

Sources: U.S. Department of Education, Federal Student Aid, Beginning Phased Implementation of the FAFSA Simplification Act (EA ID: GENERAL-21-39) (https://fsapartners.ed.gov/knowledge-center/library/electronic-announcements/2021-06-11/beginning-phased-implementation-fafsa-simplification-act-ea-id-general-21-39); NASFAA, NASFAA Deep Dive: Changes to Federal Methodology, Other Student Aid Changes From Spending Bill (https://www.nasfaa.org/news-item/24269/NASFAA_Deep-Dive_Changes_to_Federal_Methodology_Other_Student_Aid_Changes_From_Spending_Bill); NASFAA, FY 2022 Spending Bill Includes Clarifications, Improvements to FAFSA Simplification Act (https://www.nasfaa.org/news-item/26984/FY_2022_Spending_Bill_Includes_Clarifications_Improvements_to_FAFSA_Simplification_Act).

Student Loan Repayment Pause Repeatedly Extended As the COVID-19 Pandemic Continues

| Repayment Extension | |

|---|---|

| March 20, 2020 | Loan payments are suspended. Collections on defaulted loans are stopped. Loans are put into automatic forbearance and interest rates are set to zero percent. Was originally intended to last for 60 days. |

| March 27, 2020 | The CARES Act extended the payment pause through September 30, 2020 and continued the zero percent interest rate. |

| August 8, 2020 | The Department of Education is ordered to extend the student loan relief policies in the CARES Act through the end of the calendar year (December 31, 2020). |

| December 4, 2020 | The payment pause is extended through the end of January 2021. |

| January 20, 2021 | The payment pause is extended through the end of September 2021. |

| August 6, 2021 | The payment pause is extended through the end of January 2022, referred to at the time as a final extension. |

| December 22, 2021 | The payment pause is extended another 90 days through May 1, 2022. |

| April 6, 2022 | The payment pause is extended another 120 days through the end of August, 2022. |

| August 24, 2022 | The payment pause is extended through the end of the year (December 31, 2022), along with an announcement of debt cancellation for some borrowers. |

Sources: U.S. Department of Education, Federal Student Aid, COVID-19 Emergency Relief and Federal Student Aid (https://studentaid.gov/announcements-events/covid-19).

COVID-19 Legislation Aims to Help Higher Education Institutions and Students

Federal Aid for Higher Education at Texas Institutions

| CARES Act | Consolidated Appropriations Act | |

|---|---|---|

| Student aid | $511,010,443 | $505,497,586 |

| Institutional Assistance | $511,010,443 | $1,225,520,018 |

Sources: CARES Act Text of Bill (https://www.nasfaa.org/uploads/documents/CARES_Act_Final_Text.pdf); Student Loan Payment Delay: MarketWatch.com, “$2 trillion coronavirus stimulus package lets some student-loan borrowers delay payments for six months” (https://www.marketwatch.com/story/2-trillion-coronavirus-stimulus-bill-gives-student-loan-borrowers-six-months-of-relief-2020-03-26); Extended Student Loan Payment Delay: U.S. Department of Education, Federal Student Aid, “Coronavirus and Forbearance Info for Students, Borrowers, and Parents (Coronavirus and Forbearance Info for Students, Borrowers, and Parents | Federal Student Aid); Consolidated Appropriations Act: National Association of Student Financial Aid Administrators, “Congress Releases Bipartisan Year-End Spending Deal, FAFSA Simplification, COVID Relief, and Other Student Aid Provisions (NASFAA | Congress Releases Bipartisan Year-End Spending Deal, FAFSA Simplification, COVID Relief, and Other Student Aid Provisions)

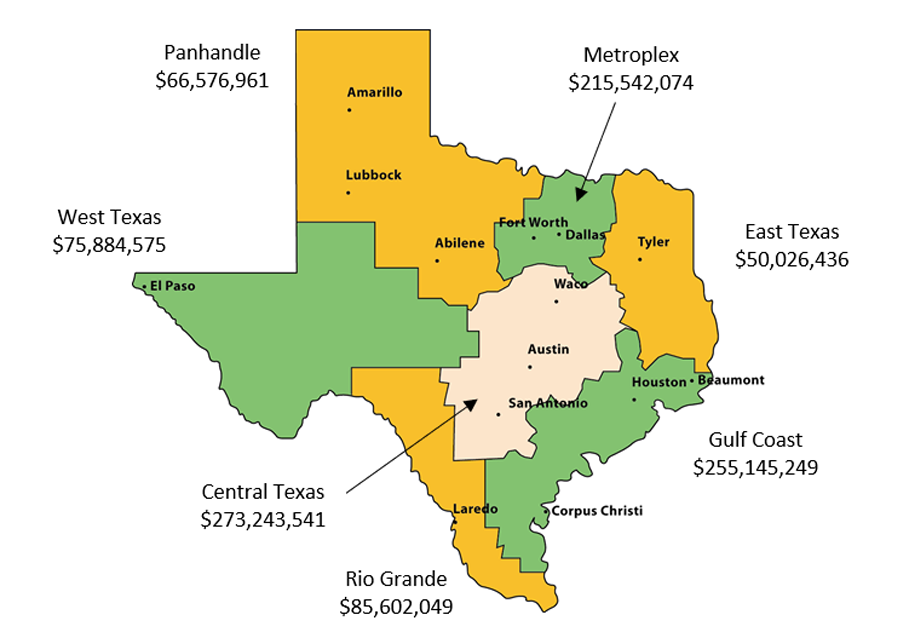

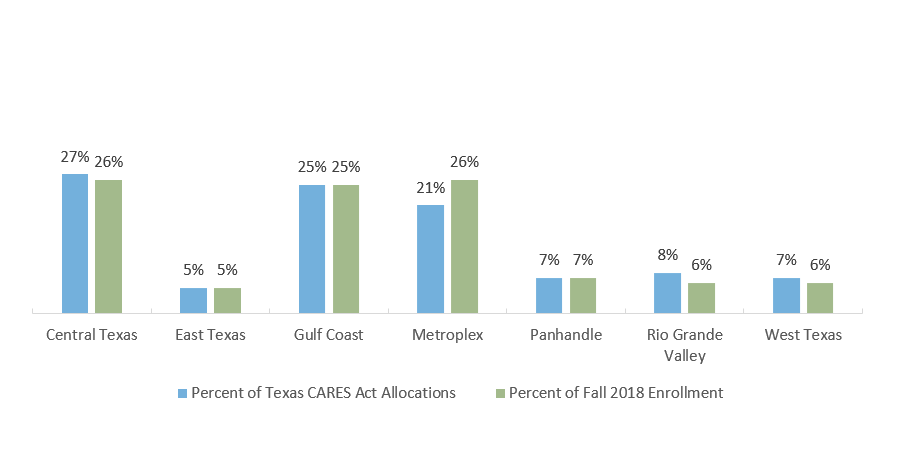

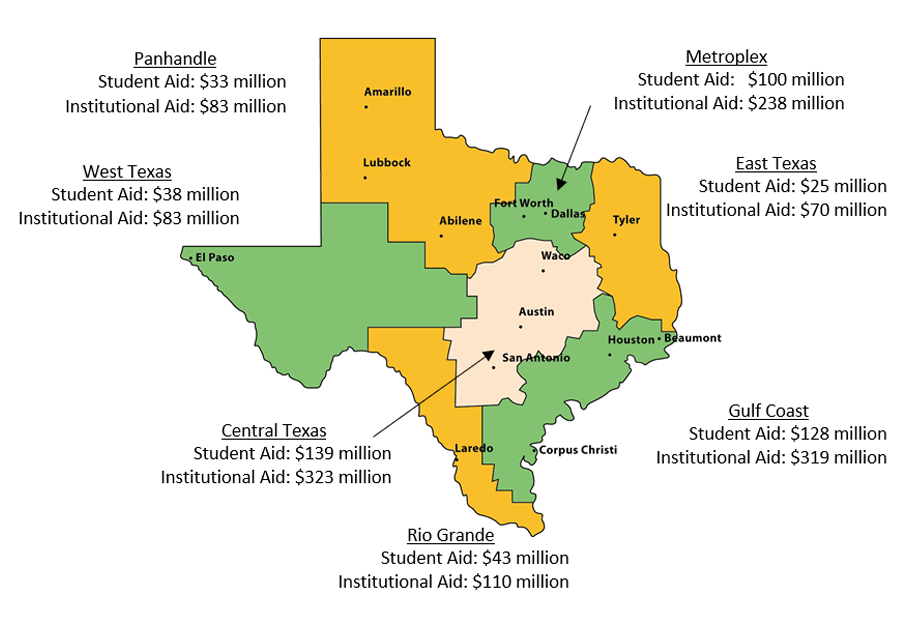

CARES Act Allocations in Texas Regions

CARES Act Allocations at Texas Institutions by Region

CARES Act Allocations at Texas Institutions by Region

Sources: U.S. Department of Education, Allocations for Section 18004(a)(1) of the CARES Act (https://www2.ed.gov/about/offices/list/ope/allocationsforsection18004a1ofcaresact.pdf); Enrollment by Region: U.S. Department of Education, National Center for Education Statistics, IPEDS Data (http://www.nces.ed.gov/ipeds/).

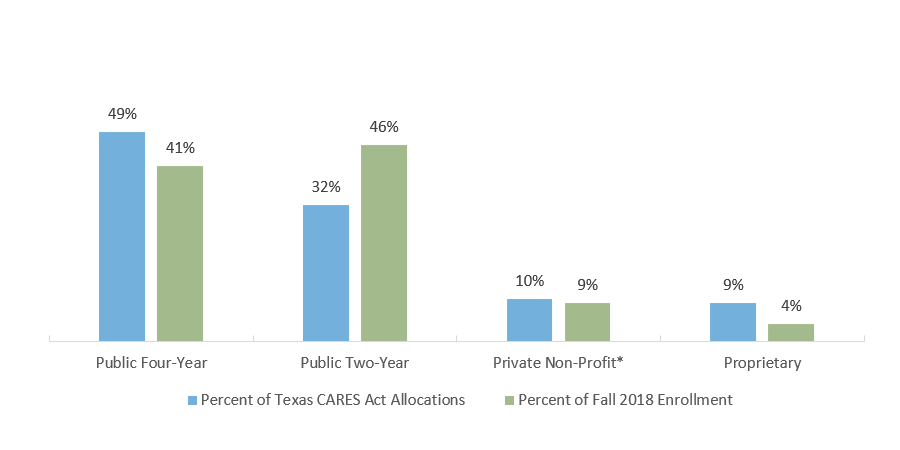

CARES Act Allocations Vary by Sector in Texas

CARES Act Allocations at Texas Institutions by Sector

| School Type | Total Allocations | Number of Institutions |

|---|---|---|

| Public Four-Year | $500,029,127 | 43 |

| Private Non-Profit* | $105,694,744 | 68 |

| Pubic Two-Year | $328,113,876 | 64 |

| Proprietary | $88,183,138 | 121 |

*This category includes 4-year or above, 2-year, and less-than 2-year institutions. Ninety percent of the Private Non-Profit Texas institutions receiving allocations are 4-year or above.

Sources: U.S. Department of Education, Allocations for Section 18004(a)(1) of the CARES Act (https://www2.ed.gov/about/offices/list/ope/allocationsforsection18004a1ofcaresact.pdf); Enrollment by Sector: U.S. Department of Education, National Center for Education Statistics, IPEDS Data (http://www.nces.ed.gov/ipeds/).

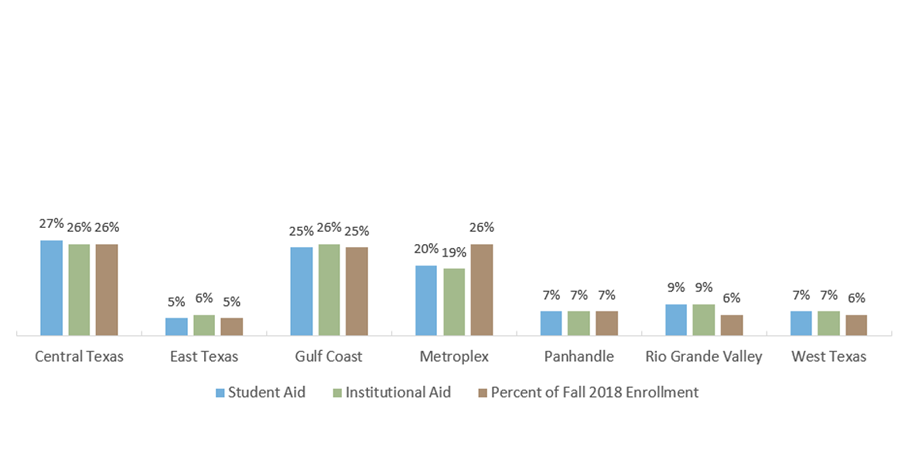

Consolidated Appropriations Act Allocates Aid to Areas of Greatest Need

Consolidated Appropriations Act Allocations at Texas Institutions by Region

Consolidated Appropriations Act Allocations at Texas Institutions by Region

Sources: Consolidated Appropriations Act Allocations: U.S. Department of Education, “CRRSAA: Higher Education Emergency Relief Fund (HEERF II) (https://www2.ed.gov/about/offices/list/ope/ccrrsaa.html); Enrollment by Sector: U.S. Department of Education, National Center for Education Statistics, IPEDS Data (http://www.nces.ed.gov/ipeds/).

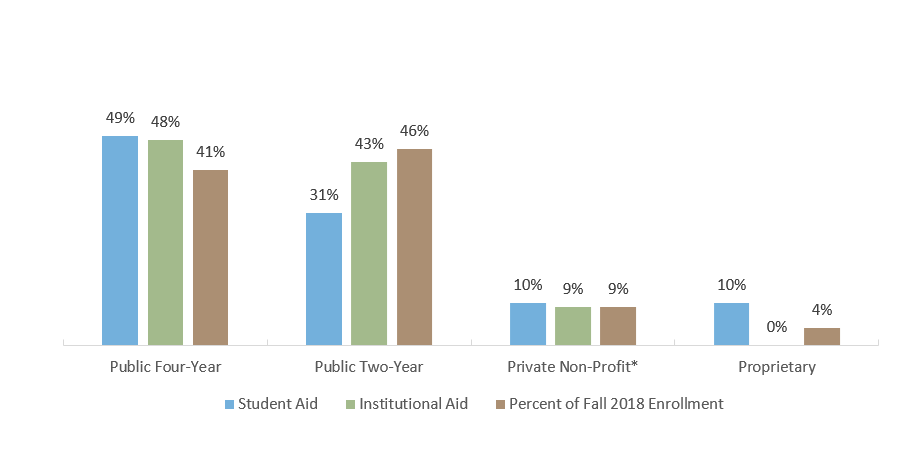

Consolidated Appropriations Act Channels Relief Disproportionately to Public Four-Year Sector

Consolidated Appropriations Act Allocations at Texas Institutions by Sector

| School Type | Student Aid | Institutional Aid | Number of Institutions |

|---|---|---|---|

| Public Four-Year | $249,298,069 | $583,481,183 | 43 |

| Private Non-Profit* | $52,743,033 | $115,313,898 | 67 |

| Pubic Two-Year | $154,034,029 | $526,724,937 | 57 |

| Proprietary | $49,422,455 | $0 | 126 |