Income-Driven Repayment Application Tutorial

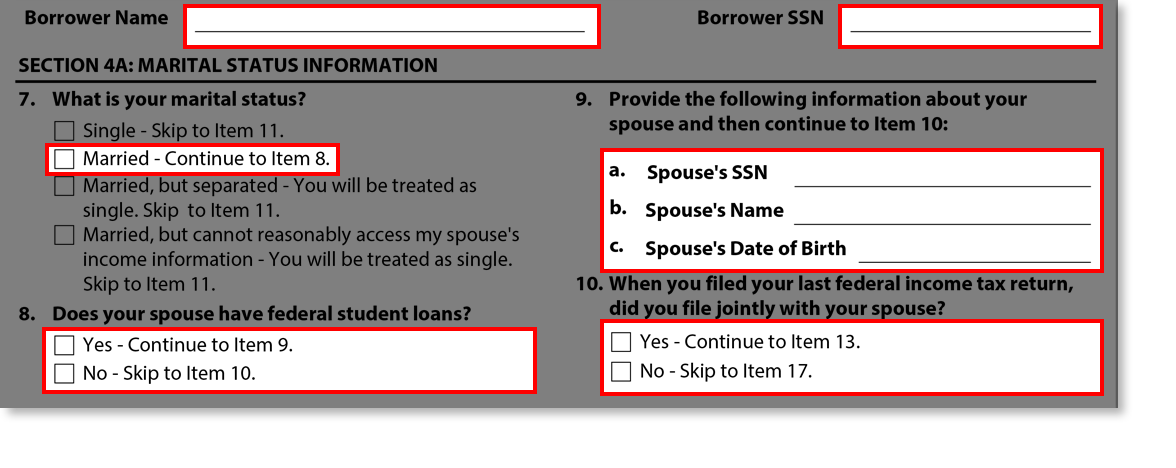

You’ve selected Married. You’ll want to complete the following sections.

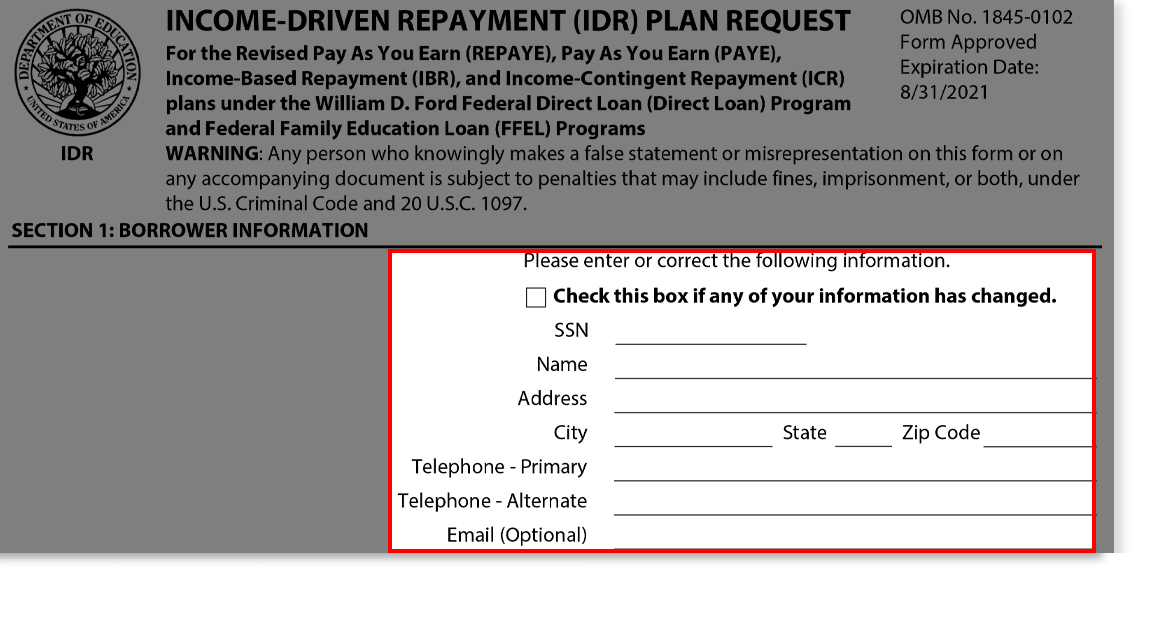

Fill in the area indicated below with your current information.

Just a reminder, you’ll need to have access to your spouse’s Social Security number, date of birth, and proof of income (such as a pay stub).

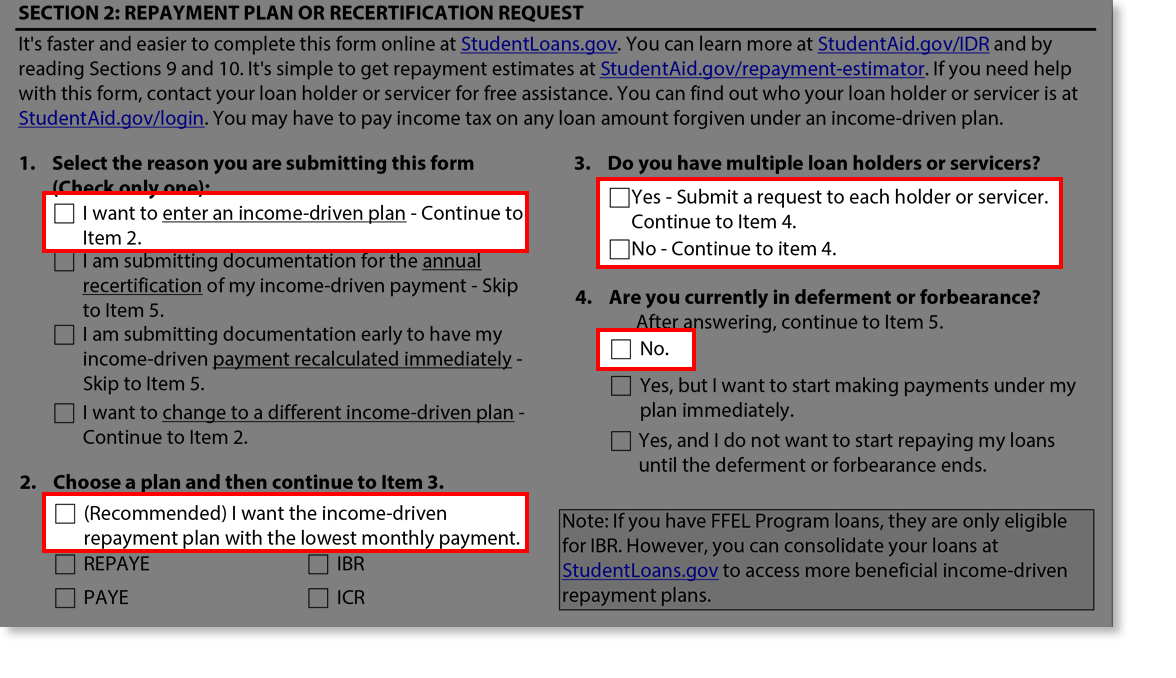

- Check the first box to begin an income-driven plan.

- Check the first box to select the plan with the lowest monthly payment.

- Do you have multiple loan servicers? Neither choice will impact your application, but you’ll want to send a separate application to each servicer.

- As part of loan rehabilitation, you are not in deferment or forbearance. Check the first box.

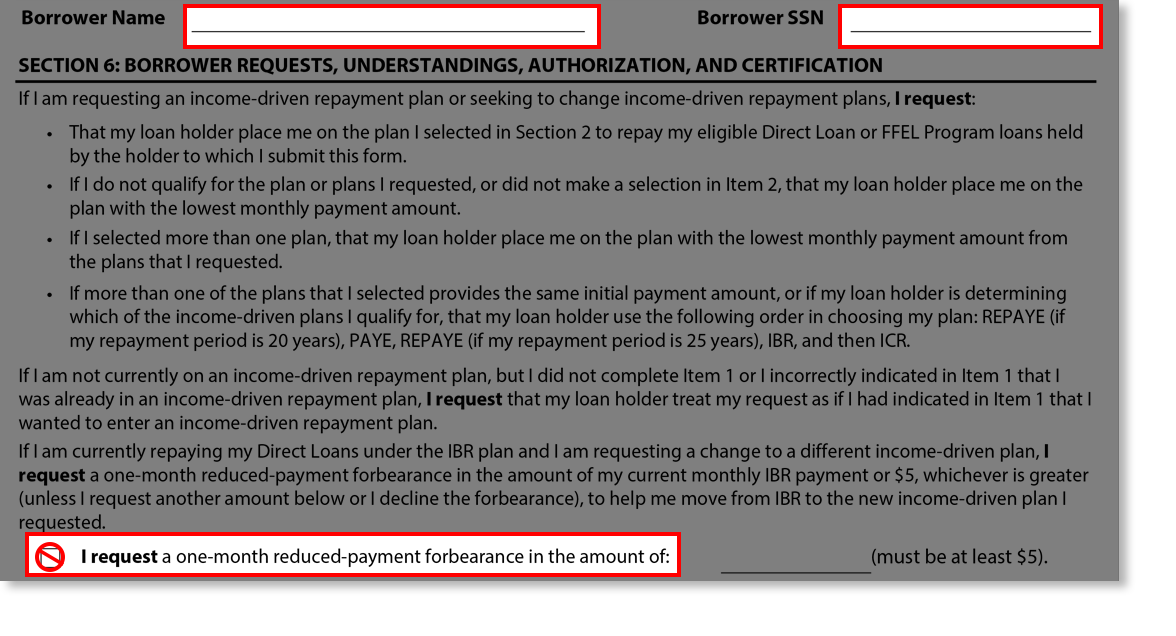

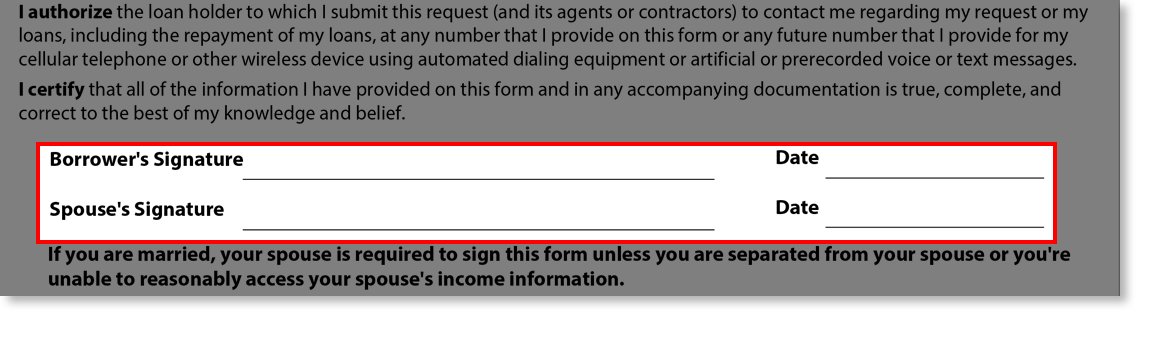

Be sure to include your name and Social Security number where indicated on the following pages.

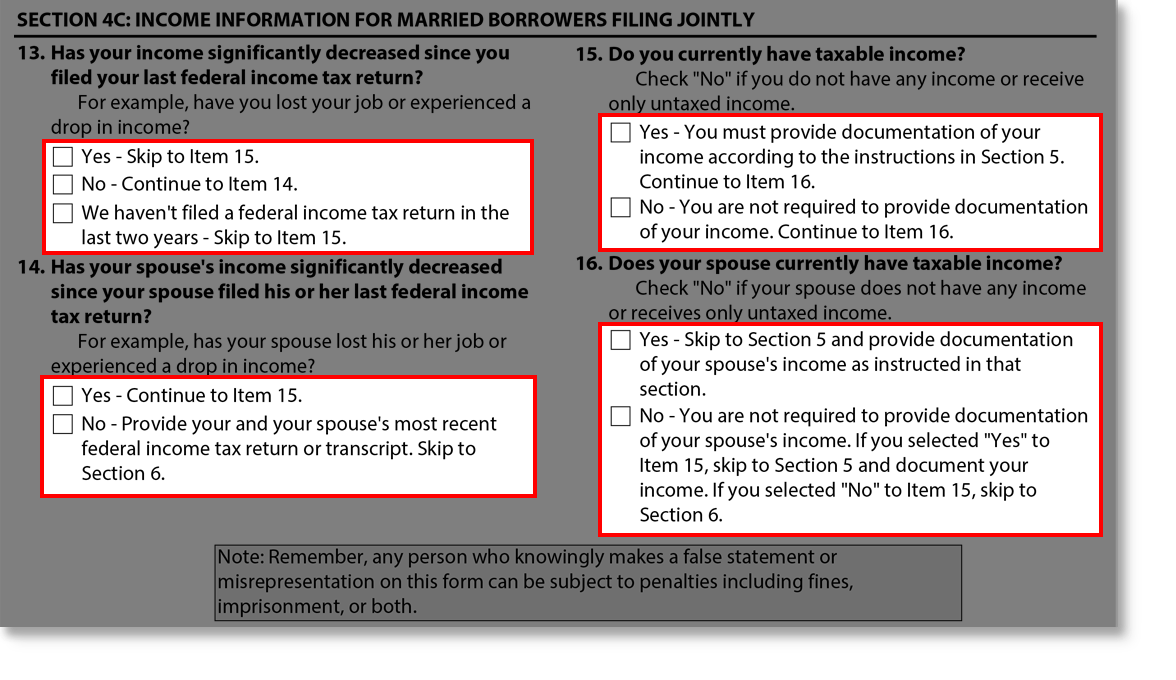

You need to fill in section 4A and 4C under your situation.

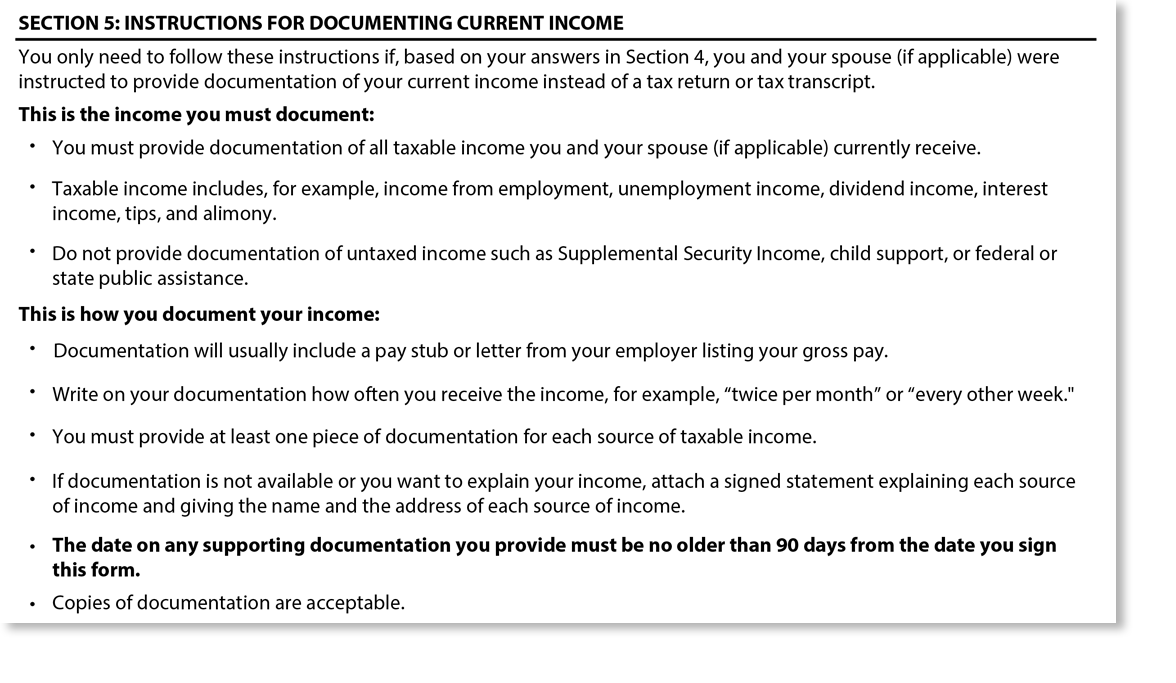

You will need to include a copy of your most recent tax return with this application, unless you haven’t filed or your income has changed significantly. In that case, see section 5.

Section 4C is for married borrowers who filed a joint tax return with their spouse.

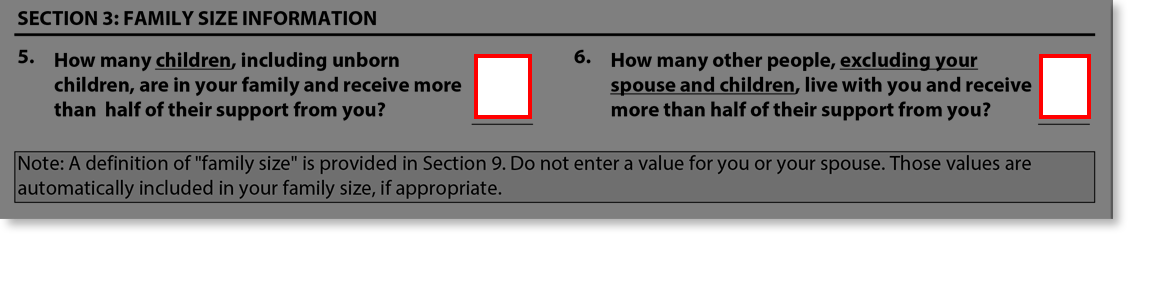

Fill in the areas indicated below.